- Phonepe

- contact phonepe customer

- use phonepe gift card

- apply qr code phonepe

- pay challan phonepe

- recharge fastag phonepe

- refer phonepe

- unblock phonepe account

- use phonepe scratch

- book train ticket

- change banking name

- send money google pay

- set autopay phonepe

- raise ticket phonepe

- complete kyc phonepe

- add beneficiary account

- check transaction phonepe

- view account number

- sell gold phonepe

- buy gold phonepe

- change phonepe business

- logout phonepe account

- pay gas bill

- unlink phonepe account

- change upi pin

- delete phonepe account

- add bank account

- create upi phonepe

- use phonepe wallet

- reset upi pin

- use phonepe

- remove bank account

- add credit card

- change transaction limit

- close phonepe wallet

- change phonepe password

- change primary account

- check fastag balance

- delete business account

- cancel autopay phonepe

- check balance phonepe

- claim phonepe gift card

- install two phonepe apps

- check phonepe upi id

- remove phonepe bank account

- deactivate phonepe upi id

- delete phonepe upi id

- remove the account from phonepe

- recharge airtel in phonepe

- use phonepe for money transfer

- recharge metro card by phonepe

- recharge idea from phonepe

- add a new account in phonepe

- recharge phonepe wallet credit

- add credit card in phonepe app

- add double account in phonepe

- add rupay card phonepe

- delete card phonepe

- recharge d2h by phonepe

- reset phonepe bhim upi pin

- use phonepe scan and pay

- recharge phonepe wallet

- recharge play store phonepe

- recharge tata sky in phonepe

- check upi id on phonepe

- activate phonepe upi id

- use phonepe qr code

- install phonepe app in mobile

- create phonepe account

- recharge airtel dth phonepe

- block contact phonepe

- disable phonepe upi

- unblock contacts in phonepe

- pay bills using phonepe wallet

- recharge using wallet

- send money phonepe to bank

How to complete KYC in Phonepe

In today's fast-paced digital era, mobile payment platforms have revolutionized the way we handle financial transactions. PhonePe, a leading player in the digital payments landscape, has emerged as a reliable and user-friendly platform, empowering millions with secure and convenient payment options. To ensure the highest level of security and regulatory compliance, PhonePe requires users to complete their KYC (Know Your Customer) verification process.

KYC plays a crucial role in safeguarding user information and preventing fraudulent activities. By authenticating the identity of its users, PhonePe ensures a trusted and seamless experience for individuals seeking to make hassle-free transactions. With an aim to simplify the KYC process, PhonePe has introduced user-friendly methods that allow users to complete their verification directly within the app.

Complete KYC in Phonepe: 7 Steps

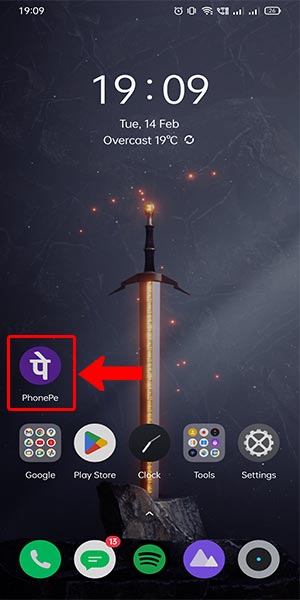

Step 1: Open phonepe - Open the PhonePe mobile application on your smartphone.

- Ensure that you have a stable internet connection for a seamless experience.

- Log in to your PhonePe account using your registered mobile number and password.

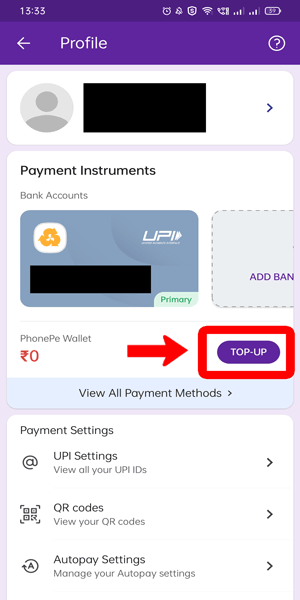

Step 2: Select account - Once you are logged in, locate and tap on the "Account" icon or tab at the bottom of the screen.

- This will take you to your account settings and options.

Step 3: Select TOPUP - Within the Account section, find and tap on the "Topup" option.

- This option allows you to manage your account settings and access additional features.

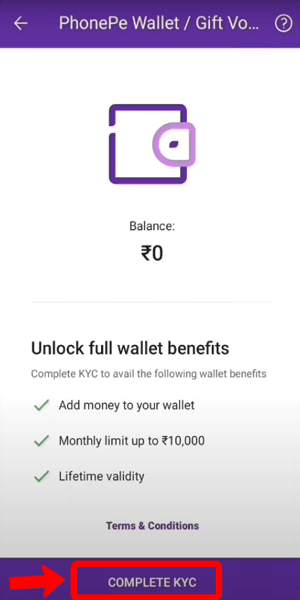

Step 4: Select complete KYC - In the Topup section, look for the "Complete KYC" option and tap on it.

- PhonePe will require you to complete the KYC process to enhance your account security and transaction limits.

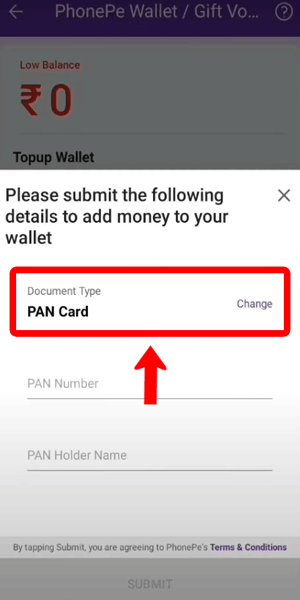

Step 5: Change the document type - Once you are on the Complete KYC page, you will see an option to select the document type for verification.

- Tap on the drop-down menu and select the appropriate document type, such as Aadhaar card, PAN card, or passport, based on the options provided.

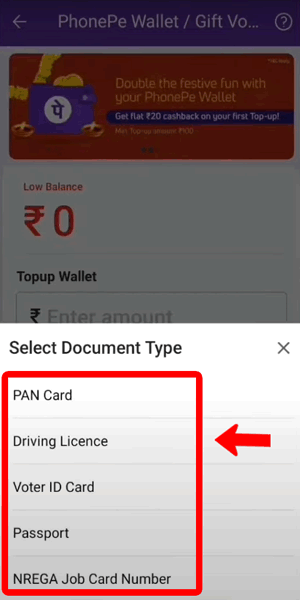

Step 6: Choose the document - After selecting the document type, you will be prompted to choose the specific document you wish to use for verification.

- Select the document from the list that matches the one you have available for KYC.

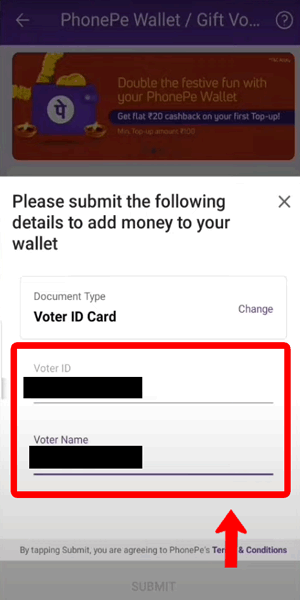

Step 7: Enter the details and submit - Once you have chosen the document, you will be asked to enter the relevant details as mentioned in the selected document.

- Carefully enter the required information, such as the document number, your full name, date of birth, and other necessary details.

- After entering the details, review them for accuracy, and then click on the "Submit" button to proceed with the KYC verification process.

Completing KYC in PhonePe is a straightforward process that ensures the security and authenticity of your account. By following these step-by-step instructions, you can easily complete your KYC verification within the PhonePe app. Remember to have the required document handy, double-check the entered information, and submit accurate details to avoid any delays or issues during the verification process. Once your KYC is successfully completed, you can enjoy enhanced features, higher transaction limits, and a more secure digital payment experience.

Tips

- Ensure that the document you select for KYC is valid and not expired.

- Double-check the accuracy of the entered details before submitting them for verification.

- Keep the original document accessible for reference and verification purposes throughout the process.

FAQ

What documents are accepted for KYC verification in PhonePe?

PhonePe accepts documents such as Aadhaar card, PAN card, passport, driver's license, and voter ID for KYC verification. Make sure the document you choose is valid and not expired.

How long does it take to complete the KYC process in PhonePe?

The KYC process in PhonePe typically takes a few minutes to complete. However, the verification may take longer in certain cases, depending on the document and information provided.

Can I complete KYC verification for multiple accounts using the same document?

No, you cannot use the same document to complete KYC for multiple PhonePe accounts. Each account needs to have a separate and unique KYC verification.

Is it mandatory to complete KYC in PhonePe?

Yes, completing KYC is mandatory in PhonePe to enjoy the full range of services and features offered. It enhances security and increases transaction limits on your account.

What happens if I don't complete KYC in PhonePe?

If you don't complete KYC in PhonePe, your account will have certain limitations, such as lower transaction limits and restricted access to certain features. Completing KYC ensures a more seamless and unrestricted experience.

Can I complete KYC using someone else's documents in PhonePe?

No, KYC verification in PhonePe should be completed using your own valid documents. Using someone else's documents is against the terms and conditions and may result in account suspension.

How can I update my KYC details in PhonePe?

If you need to update your KYC details in PhonePe, you can reach out to PhonePe customer support for assistance. They will guide you through the process and provide the necessary instructions.

Related Article

- How to Add a New Account in PhonePe

- How to Recharge PhonePe Wallet with Credit Card

- How to Add Credit Card in PhonePe App

- How to Add Double Account in PhonePe

- How to Add Rupay Card in Phonepe

- How to Delete Card Details in Phonepe

- How to Recharge D2h by Phonepe

- How to Reset Phonepe Bhim UPI Pin

- How to Use Phonepe Scan and Pay

- How to Recharge Phonepe Wallet with Debit Card

- More Articles...