- Phonepe

- contact phonepe customer

- use phonepe gift card

- apply qr code phonepe

- pay challan phonepe

- recharge fastag phonepe

- refer phonepe

- unblock phonepe account

- use phonepe scratch

- book train ticket

- change banking name

- send money google pay

- set autopay phonepe

- raise ticket phonepe

- complete kyc phonepe

- add beneficiary account

- check transaction phonepe

- view account number

- sell gold phonepe

- buy gold phonepe

- change phonepe business

- logout phonepe account

- pay gas bill

- unlink phonepe account

- change upi pin

- delete phonepe account

- add bank account

- create upi phonepe

- use phonepe wallet

- reset upi pin

- use phonepe

- remove bank account

- add credit card

- change transaction limit

- close phonepe wallet

- change phonepe password

- change primary account

- check fastag balance

- delete business account

- cancel autopay phonepe

- check balance phonepe

- claim phonepe gift card

- install two phonepe apps

- check phonepe upi id

- remove phonepe bank account

- deactivate phonepe upi id

- delete phonepe upi id

- remove the account from phonepe

- recharge airtel in phonepe

- use phonepe for money transfer

- recharge metro card by phonepe

- recharge idea from phonepe

- add a new account in phonepe

- recharge phonepe wallet credit

- add credit card in phonepe app

- add double account in phonepe

- add rupay card phonepe

- delete card phonepe

- recharge d2h by phonepe

- reset phonepe bhim upi pin

- use phonepe scan and pay

- recharge phonepe wallet

- recharge play store phonepe

- recharge tata sky in phonepe

- check upi id on phonepe

- activate phonepe upi id

- use phonepe qr code

- install phonepe app in mobile

- create phonepe account

- recharge airtel dth phonepe

- block contact phonepe

- disable phonepe upi

- unblock contacts in phonepe

- pay bills using phonepe wallet

- recharge using wallet

- send money phonepe to bank

How to change phonepe business bank account

Are you a business owner looking to streamline your financial operations? If so, it's time to consider a change. Switching to a PhonePe business bank account can be a game-changer for your organization. With its innovative features and seamless integration, PhonePe offers a comprehensive solution that simplifies your financial management and boosts your business growth. In this blog post, we will explore the benefits of transitioning to a PhonePe business bank account and how it can revolutionize the way you handle your finances. Get ready to embrace the future of banking for businesses.

Change the phonepe business bank account: 4 Steps

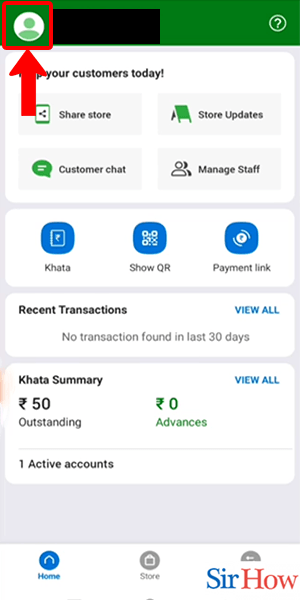

Step 1: Open phonepe business - Launch the PhonePe Business app on your smartphone.

- Log in to your business account using your credentials.

- Ensure that you have a stable internet connection to proceed smoothly.

Step 2: Select the account - Once you're logged in, navigate to the main dashboard.

- Look for the "Settings" or "Profile" section. It may be represented by a gear or profile icon.

- Tap on the "Account" option to access your account settings.

- Before proceeding, make sure you have the necessary documentation and information related to your new bank account. This may include your new account details, account holder information, and any necessary identification documents.

- It's advisable to inform your existing bank about your decision to switch and inquire about any potential fees or requirements associated with closing your current business bank account.

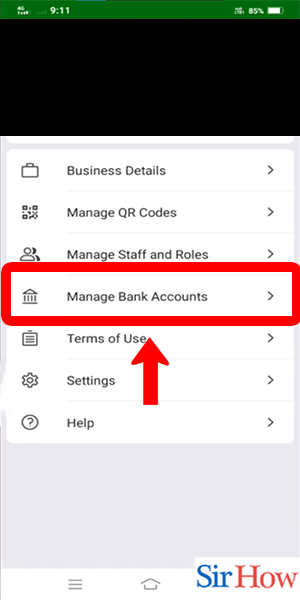

Step 3: Select manage a bank account - In the account settings section, locate and tap on the "Manage Bank Accounts" or similar option.

- You may be prompted to enter your PhonePe Business PIN or provide biometric authentication for security purposes.

- Once verified, you will be directed to a page displaying your existing bank account details.

- Before proceeding, double-check that you have selected the correct bank account to change. Review the account details to ensure accuracy.

- If you haven't added your new bank account to PhonePe Business yet, you may need to follow the steps to add a new bank account before proceeding with the change.

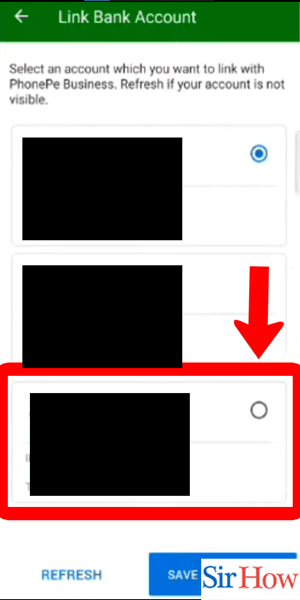

Step 4: Select the bank account proceed -

- Look for the option that allows you to change your bank account and tap on it. It may be labeled as "Change Bank Account," "Switch Account," or similar.

- You will be presented with a list of available bank accounts linked to your PhonePe Business.

- Select the desired bank account from the list and proceed with the change.

- While selecting the new bank account, consider factors such as fees, services offered, convenience, and any additional benefits provided by the bank.

- Take note of any actions required from your end, such as signing new documents or authorizing the change with your new bank.

Changing your PhonePe Business bank account can be a straightforward process when you follow these steps. By leveraging PhonePe's user-friendly interface and seamless integration, you can effortlessly transition to a new bank account that better suits your business needs. Remember to gather the necessary information, verify the details, and make informed decisions throughout the process. Streamline your finances, enhance efficiency, and unlock new possibilities for your business with a PhonePe business bank account.

Tips

- Familiarize yourself with the features and benefits of the new bank account to make the most of its offerings.

- Regularly review your financial transactions and statements to ensure accuracy and identify any discrepancies promptly.

- Stay updated with PhonePe Business app updates and banking regulations to make the most of the platform and stay compliant.

FAQ

Can I change my PhonePe Business bank account anytime?

Yes, you can change your PhonePe Business bank account at any time by following the provided steps.

Will changing my bank account affect my ongoing transactions?

No, your ongoing transactions will not be affected by changing your PhonePe Business bank account. However, ensure that you update the new account details for future transactions.

Are there any fees associated with changing my bank account on PhonePe Business?

PhonePe does not charge any fees for changing your bank account. However, your new bank may have its own fee structure, so it's advisable to check with them.

Related Article

- How to Delete Card Details in Phonepe

- How to Recharge D2h by Phonepe

- How to Reset Phonepe Bhim UPI Pin

- How to Use Phonepe Scan and Pay

- How to Recharge Phonepe Wallet with Debit Card

- How to Recharge Play Store with Phonepe

- How to Recharge Tata Sky in Phonepe

- How Find UPI ID on PhonePe App

- How to Activate Phonepe UPI ID

- How to Use Phonepe QR Code

- More Articles...