- Phonepe

- contact phonepe customer

- use phonepe gift card

- apply qr code phonepe

- pay challan phonepe

- recharge fastag phonepe

- refer phonepe

- unblock phonepe account

- use phonepe scratch

- book train ticket

- change banking name

- send money google pay

- set autopay phonepe

- raise ticket phonepe

- complete kyc phonepe

- add beneficiary account

- check transaction phonepe

- view account number

- sell gold phonepe

- buy gold phonepe

- change phonepe business

- logout phonepe account

- pay gas bill

- unlink phonepe account

- change upi pin

- delete phonepe account

- add bank account

- create upi phonepe

- use phonepe wallet

- reset upi pin

- use phonepe

- remove bank account

- add credit card

- change transaction limit

- close phonepe wallet

- change phonepe password

- change primary account

- check fastag balance

- delete business account

- cancel autopay phonepe

- check balance phonepe

- claim phonepe gift card

- install two phonepe apps

- check phonepe upi id

- remove phonepe bank account

- deactivate phonepe upi id

- delete phonepe upi id

- remove the account from phonepe

- recharge airtel in phonepe

- use phonepe for money transfer

- recharge metro card by phonepe

- recharge idea from phonepe

- add a new account in phonepe

- recharge phonepe wallet credit

- add credit card in phonepe app

- add double account in phonepe

- add rupay card phonepe

- delete card phonepe

- recharge d2h by phonepe

- reset phonepe bhim upi pin

- use phonepe scan and pay

- recharge phonepe wallet

- recharge play store phonepe

- recharge tata sky in phonepe

- check upi id on phonepe

- activate phonepe upi id

- use phonepe qr code

- install phonepe app in mobile

- create phonepe account

- recharge airtel dth phonepe

- block contact phonepe

- disable phonepe upi

- unblock contacts in phonepe

- pay bills using phonepe wallet

- recharge using wallet

- send money phonepe to bank

How to Deactivate PhonePe UPI ID

UPI ID are helpful to transfer amount from our bank account to the recipients bank account or receive money in our bank account, without sharing much of our personal or bank details. This article briefly describes you on how to deactivate your PhonePe UPI ID.

Delete Phonepe UPI ID (Video)

Deactivate PhonePe UPI ID: 4 Steps

Step 1 Open PhonePe application: The PhonePe application must first be downloaded.

- You can obtain it via the Google Play Store if you have an Android device. It's available for Apple devices via the App Store.

- To set up a PhonePe account, enter a new user name and phone number. You will be given an OTP in order to verify your identity.

- To connect your back account, you must first fill up your basic information and account information.

- You're ready to use PhonePe now.

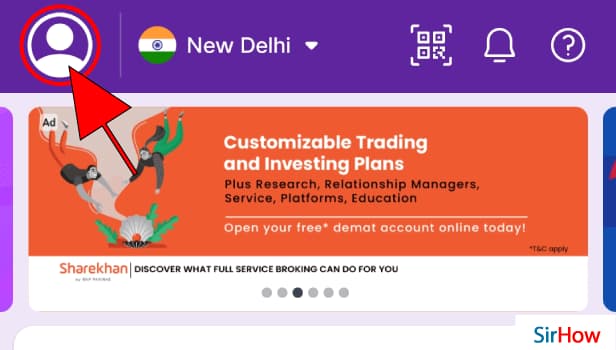

Step 2 Go to your profile: This page has a few advertisements as well as all of the payment and billing options.

- You may also make new payments from this page.

- From here, you may learn how to make a new payment.

- Your profile option will be on the top left side.

- Once, tap on it.

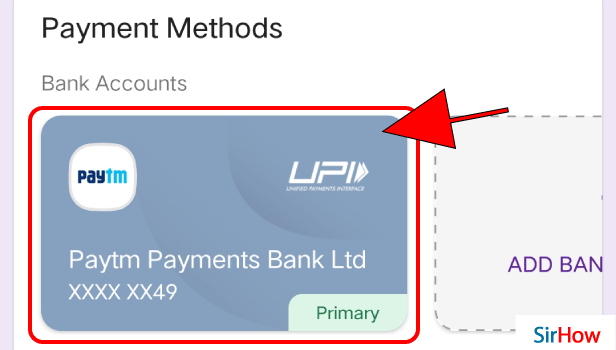

Step 3 Select bank account: You'll now be able to see all of your accounts.

- You can add two accounts to your PhonePe account.

- You may find instructions for doing so here.

- Now choose the account you'd like to delete.

- Tap the account you wish to delete once.

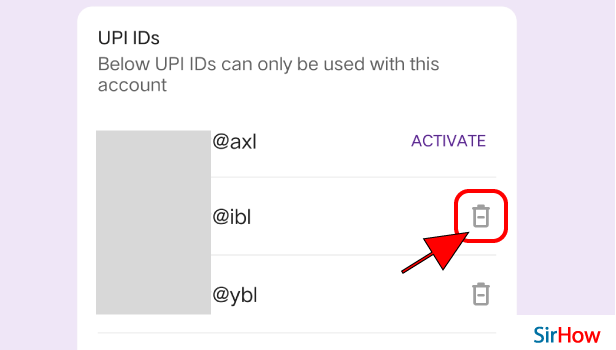

Step 4 In UPI IDs section click on delete icon: Here you'll find the UPIs associated with your bank.

- You'll find a list of UPIs.

- You can delete the one you don't want.

- But after deleting, you can't restore them.

Here's how you can make PhonePe work for you:

1. Shop online using a variety of e-commerce sites and pay using UPI.

2. Pay your utility bills.

3. UPI allows you to send or receive money using your phone contact list.

4. Pay for DTH connections as well as prepaid mobile phones.

5. Check your bank account balance on a regular basis.

6. Make a beneficiary list.

7. Use several bank accounts

8. Examine numerous cashback options.

9. Divide payments and split bills

PhonePe Private Limited is India's most popular e-commerce payment platform. In December of 2015, the digital wallet firm was created. This portal provides services in more than 11 regional Indian languages. You may use the app to book cabs, buy hotel services, purchase meals online, pay for Redbus tickets, and pay for aeroplane tickets as a user. PhonePe is a mobile payment platform that allows you to send money via UPI, recharge phone numbers, and pay utility bills, among other things. PhonePe uses the Unified Payment Interface (UPI) technology, and all you have to do is enter your bank account information and generate a UPI ID.

The nicest part about UPI is that it is available 24 hours a day, seven days a week, and may even be utilised on holidays and weekends. On both Android and Apple phones, the app may be downloaded.

FAQ

1. Is PhonePe a safe application?

PhonePe is completely secure and safe. Yes Bank is the driving force behind it. All transactions are processed over secure banking networks, and the app does not save any user information or passwords. You just need to input your MPIN once for each transaction.

2. Is it easy to make payments, with PhonePe?

Pay your postpaid and utility bills using your PhonePe app, as well as replenish your prepaid mobile number, data card, and DTH. Enter their phone number, name, or VPA to send or request money from loved ones. After a movie, do you want to divide the popcorn bill with your friends? You can do it as well with the PhonePe app! You may also use QR codes to pay or check your bank account balance.