- India

- check air india flight

- register drone india

- employment exchange

- eloc for business

- emp. exchange haryana

- gun license india

- online fir india

- register on pmkvy

- employment exchange kerala

- apply for pmfby

- register udhyog aadhar

- traffic rules india

- pcc india

- online fir haryana

- block sbi card

- invest mutual funds

- rti application online

- complaint against bank

- caste certificate india

- u.s visa appointment

- iim admission

- aadhar card update

- divorce in india

- complaint against police

- tata power bill

- dhbvn and uhbvn

- store documents digilocker

- cbse digital marksheet

- renew passport

- national consumer helpline

- use paytm

- divorce rules india

- cyber crime complaint

- complaint lost mobile

- book indane gas

- fundamental rights india

- change address aadhar

- save money india

- life partner india

- contact narendra modi

How to Complaint Against Bank in India

Nothing comes without flaws and complaints. Our banking system also has some flaws and to address these flaws and complaints of consumers they need a forum. Here are two ways to complaint Against Bank.

How to File Complaint Against Bank

Banks play a crucial role in the economy of India. They are responsible for providing financial assistance to individuals and businesses. However, sometimes they fail to provide the services that they are obligated to provide, which leads to customer dissatisfaction. If you have a complaint against a bank in India, you can file a complaint with the Reserve Bank of India (RBI). In this article, we will discuss the steps you need to take to file a complaint against a bank in India.

Steps to Complaint Against Bank in India

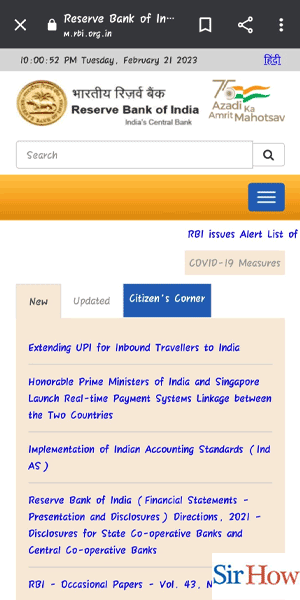

Step 1: Go to the RBI website - The first step to file a complaint against a bank in India is to visit the RBI website. The URL of the website is https://www.rbi.org.in/. Once you are on the website, click on the "Complaints" tab.

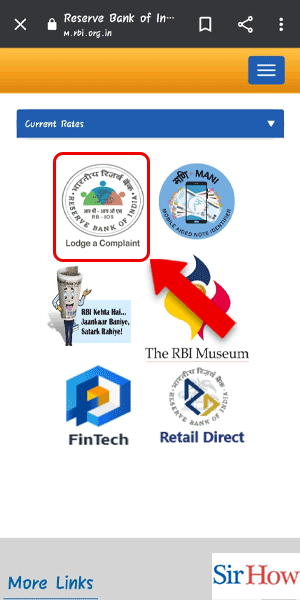

Step 2: Tap on lodge a complaint - The next step is to click on the "Lodge a complaint" button.

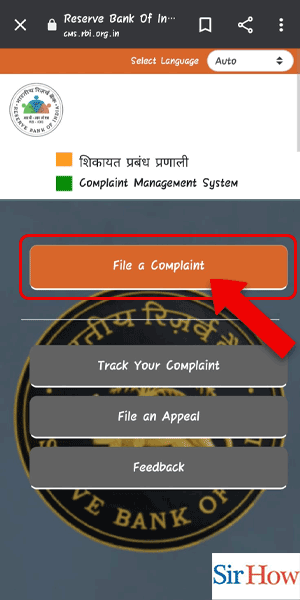

Step 3: Tap on file a complaint - Once you have clicked on the "Lodge a complaint" button, you will be taken to a page where you will be asked to choose between "File a complaint" and "Track complaint status." Click on the "File a complaint" button.

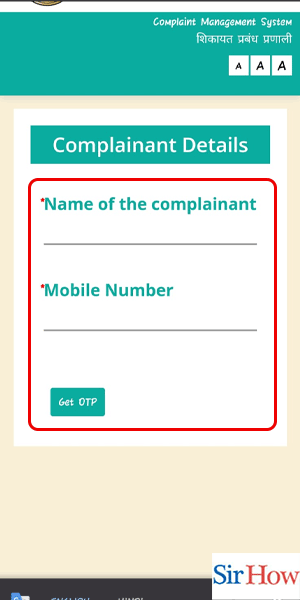

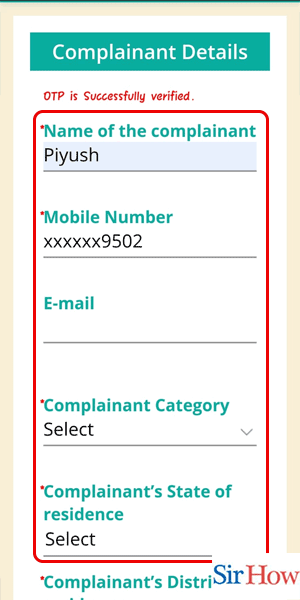

Step 4: Enter the details - The next step is to enter your personal details, such as name, address, and contact number. You will also be asked to provide details of the bank against which you want to file a complaint.

Step 5: Enter the details - In this step, you will be required to provide details of the complaint. You should describe the issue you are facing with the bank in detail. Make sure that you provide all the necessary information, such as the date of the transaction, the amount involved, and the name of the bank employee you dealt with.

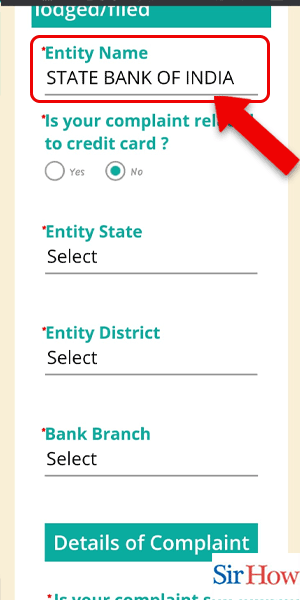

Step 6: Enter the bank name - After providing your personal details and the details of the complaint, you will be asked to enter the name of the bank against which you want to file a complaint. You should select the name of the bank from the drop-down list.

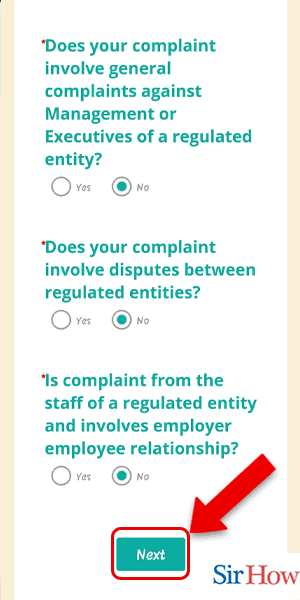

Step 7: Tap on next - Once you have entered all the details, click on the "Next" button. You will be asked to verify the details you have provided. If everything is correct, click on the "Submit" button.

Filing a complaint against a bank in India can be a time-consuming process, but it is important to take the necessary steps if you feel that you have been wronged. The RBI has put in place a mechanism to address complaints against banks, and you should use this mechanism to seek redressal for your grievances. By following the steps outlined in this article, you can file a complaint against a bank in India and ensure that your voice is heard.

FAQ

Q1. What is the maximum time limit for the bank to resolve a complaint?

A1. The maximum time limit for a bank to resolve a complaint is one month from the date of receipt of the complaint.

Q2. What should I do if the bank does not resolve my complaint?

A2. If the bank does not resolve your complaint within one month, you can escalate the matter to the banking ombudsman.

Q3. Is there a fee to file a complaint with the RBI?

A3. No, there is no fee to file a complaint with the RBI.

Q4. Can I file a complaint against a foreign bank operating in India?

A4. Yes, you can file a complaint against a foreign bank operating in India with the RBI.

Q5. Can I file a complaint against a bank online?

A5. Yes, you can file a complaint against a bank online by visiting the RBI website.

Related Article

- How to Choose Right Life Partner in India

- How to contact narendra modi (Prime minister of India)

- How to Find GAMCA Approved Medical Centre in India

- How to renew Indian passport in Qatar

- How to Apply for Tatkal Passport Online in India

- How to Remove ECR Stamp From Indian Passport

- How to Check Passport is ECR or ECNR on an Indian Passport

- How to Easily Check Passport Status Online in India

- How to Know New Address of Passport Seva Kendra

- How to Join Indian Air Force

- More Articles...