- India

- check air india flight

- register drone india

- employment exchange

- eloc for business

- emp. exchange haryana

- gun license india

- online fir india

- register on pmkvy

- employment exchange kerala

- apply for pmfby

- register udhyog aadhar

- traffic rules india

- pcc india

- online fir haryana

- block sbi card

- invest mutual funds

- rti application online

- complaint against bank

- caste certificate india

- u.s visa appointment

- iim admission

- aadhar card update

- divorce in india

- complaint against police

- tata power bill

- dhbvn and uhbvn

- store documents digilocker

- cbse digital marksheet

- renew passport

- national consumer helpline

- use paytm

- divorce rules india

- cyber crime complaint

- complaint lost mobile

- book indane gas

- fundamental rights india

- change address aadhar

- save money india

- life partner india

- contact narendra modi

How to use Paytm for Shopping and Pay Bills

Paying bills is a necessary yet tedious task that can take up a lot of our time and energy. However, with the rise of digital payment platforms, paying bills has become easier and more convenient than ever before. One such platform is Paytm, which offers a hassle-free way to pay bills online. In this article, we will discuss how to use Paytm to pay bills, step-by-step.

How to Pay In Local Shops Using Paytm

Use Paytm for Pay Bills in 4 steps

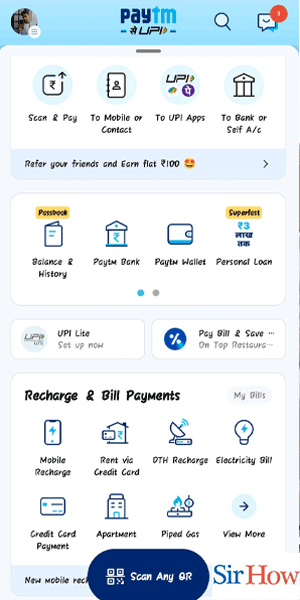

Step 1: Go to the Paytm app: To use Paytm to pay bills, the first step is to download the Paytm app from the Google Play Store or the Apple App Store. Once you have downloaded the app, open it and log in to your Paytm account. If you do not have a Paytm account, you can create one by following the on-screen instructions.

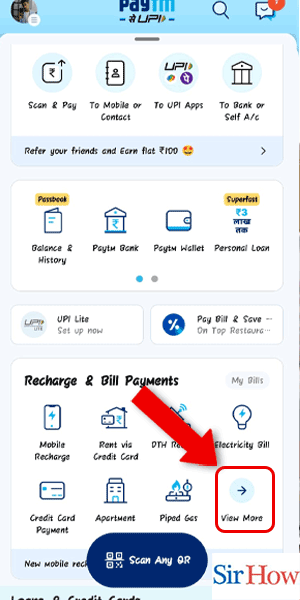

Step 2: Tap on view more - Once you have logged in to your Paytm account, you will see a home screen with various options such as mobile recharge, bill payments, movies, and more. To pay bills, tap on the 'view more' option.

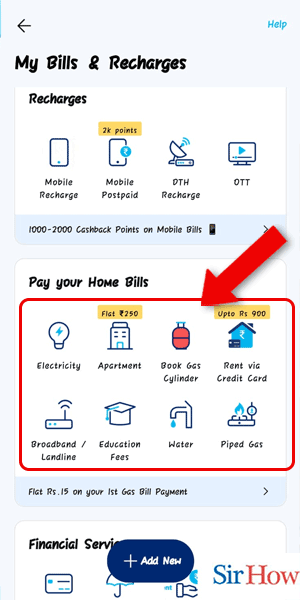

Step 3: Tap on any bill option - After tapping on 'view more', you will see a list of options such as electricity, water, gas, broadband, and more. Select the option for the bill you want to pay.

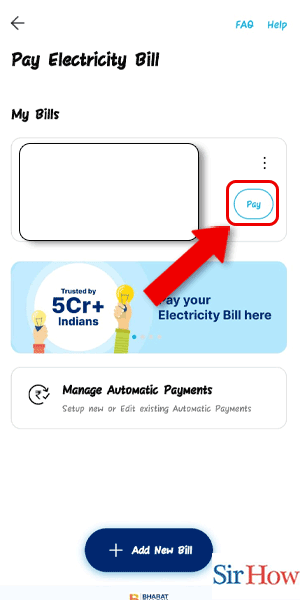

Step 4: Tap on pay - Once you have selected the bill option, you will be asked to enter the necessary details such as the bill amount, account number, and other relevant information. After verifying the details, tap on 'pay' to complete the transaction.

Paying bills is now a hassle-free and convenient process, thanks to digital payment platforms such as Paytm. With just a few clicks, you can pay all your bills from the comfort of your home or office. By following the above steps, you can easily use Paytm to pay your bills and save time and energy.

FAQ

Is Paytm a safe platform for paying bills online?

Yes, Paytm is a safe and secure platform for paying bills online. The platform uses the latest encryption and security measures to ensure that your transactions are safe and secure. Paytm is also certified by the Payment Card Industry Data Security Standard (PCI DSS) and the Reserve Bank of India (RBI), which further adds to its credibility.

Can I pay all types of bills using Paytm?

Yes, you can pay all types of bills using Paytm. Paytm allows you to pay bills for electricity, water, gas, broadband, mobile, DTH, credit card, and more. You can also pay your insurance premiums and school fees using Paytm.

How long does it take for a bill payment to reflect on the service provider's website?

The time taken for a bill payment to reflect on the service provider's website may vary depending on the service provider. In most cases, the payment reflects within a few hours. However, for some services, it may take up to 2-3 working days for the payment to reflect on the service provider's website.

What happens if I enter the wrong details while paying my bills through Paytm?

If you enter the wrong details while paying your bills through Paytm, the transaction may fail, and the amount will be refunded to your Paytm account. However, it is always recommended to double-check the details before making a payment to avoid any inconvenience.

How can I get a refund if I have overpaid my bill through Paytm?

If you have overpaid your bill through Paytm, the excess amount will be refunded to your Paytm account within a few working days. You can then use this amount to pay your future bills or transfer it to your bank account.

Is there a limit on the amount that I can pay through Paytm?

Yes, there is a limit on the amount that you can pay through Paytm. The maximum limit for bill payments through Paytm is Rs. 10,000 per transaction. However, you can make multiple transactions to pay larger bills.

Can I set reminders for bill payments on Paytm?

Yes, you can set reminders for bill payments on Paytm. Paytm allows you to set reminders for your bill payments so that you never miss a due date. You can also set up auto-pay for your bills to ensure that your payments are made on time every month.

Related Article

- How to Add Promo Code in Paytm

- How to Add Money in Paytm Wallet

- How to Recharge jio with Paytm

- How to Check Paytm Transaction History

- How to Change Password on Paytm App

- How to Create Paytm Account

- How to Check Paytm Limit

- How to Create UPI PIN in Paytm

- How to Check Cashback in Paytm

- How to Book Bus Tickets using Paytm App

- More Articles...