- UAE

- cancel work permit

- check validity uae

- get equivalency certificate

- lift travel ban

- complain domestic violence

- renew residence visa

- apply transfer residency

- get conditions getting

- apply emirates id card

- business masdar free zone

- tax number uae

- tourist facilities uae

- entry permit uae

- private sector uae

- residency visa uae

- running business uae

- how to apply for retirement golden visa in uae

- fact sheet uae

- register vat uae

- cancelling visa uae

- tourist visa in uae

- residence visa uae

- remote visa uae

- visa rules uae

- eligibility golden visa uae

- vat refunds uae

- item certificate uae

- transit visa uae

- work permit in uae

- traffic fine uae

- work permit uae

- golden visa uae nurses

- golden visa uae

- status amendment uae

- vaccination information uae

- disciplinary penalties uae

- vat registration uae

- get internships uae

- tourist visa uae

- extend visa uae

- emergency contacts uae

- visa validity uae

- how to check fine in uae

- entry tourist visa uae

- golden visa in uae

- permit in uae

- zone complaint uae

- establishment card uae

- foreign employees uae

- online business uae

- covid result online uae

- vaccination certificate uae

- shopping site uae

- e visa uae

- labor complaint uae

- new work permit uae

- labor contract uae

- electricitywater bill uae

- recruitment service uae

- list holidays uae

- domestic helpers uae

- uae driving license

- overstay fine uae

- professional jobs uae

- get pcc uae

- excise tax uae

- register trademark uae

- complain salary delay uae

- get icv certificate uae

- apply business p.o. box in uae

- apply for patent uae

- check coronavirus helpline uae

- lawyer uae

- how to report cybercrime in uae

- terminate employee uae

- uae company status

- company vat uae

- travel ban uae

- certificate attested uae

- buy data etisalat uae

- uid number uae

- visa details uae

- uae passport

- renew passport uae

- unemployment insurance uae

- annual leave uae

- tourist visa application uae

- visa expiry date uae

- file case uae

- complain company uae

- credit card uae

- police case uae

- remove travel ban uae

- overtime uae

- short term visa uae

- visa fine uae

- cehicle details uae

- job uae government

- higher education uae

- invest in uae

- health insurance policy uae

- abu dhabi's pension uae

- compute gratuity uae

- international driving license uae

- electricity water bills uae

- check travel ban in uae

- cancel uae residence visa

- education budget uae

- uae tourism

- check uae attestation

- check criminal case uae

- check vehicle details uae

- uae visit visa validity

- calculate benefit pension uae

- students code conduct

- apply for scholarships

- calculate gratuity uae

- abu dhabi visa

- pcc abu dhabi

- check traffic fines

- visa ban status

- uae visa status

- certificate attestation uae

- emirates id status

How to Check the Taxes in Tourist Facilities in UAE

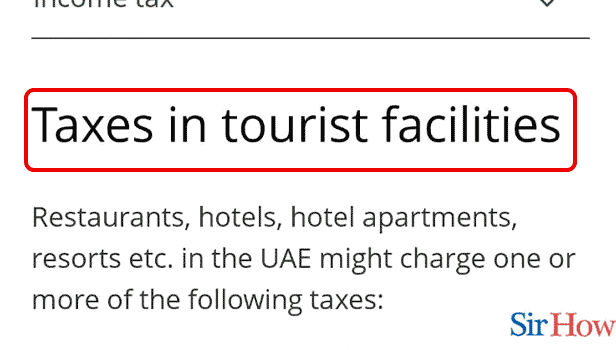

In restaurants, hotels, hotel apartments, and resorts, visitors must pay a specific fee. In the UAE, various facilities may impose one or more of these taxes. For instance, 10% of the accommodation rate, 10% of the service cost, 10% of the municipality's expenses, the city tax (which ranges from 6% to 10%), and 6% of the tourism fee. Dubai which is in UAE generates a lot of income through tourism. You must have a basic idea regarding the taxes charged. Let's look at the steps now to check the taxes in tourist facilities in UAE.

Check The Taxes In Tourist Facilities In UAE In 3 Easy Steps

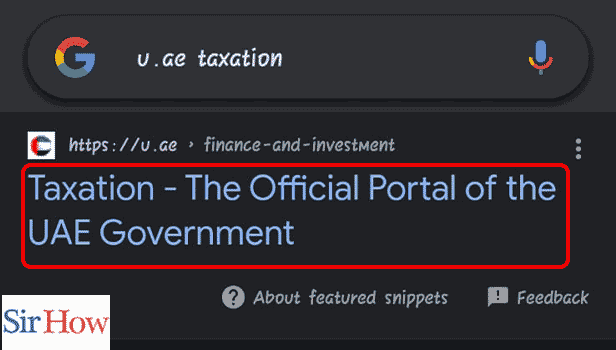

Step 1: Go to the UAE taxation page: As the first step, you need to go to the UAE taxation page. To go copy and paste the link into the browser. https://u.ae/en/information-and-services/finance-and-investment/taxation

- Then, tap on the search button.

- Otherwise directly, click on the link from here to visit the Taxation page.

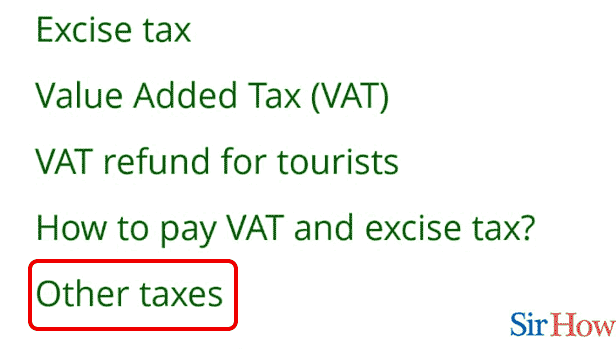

Step 2: Tap on other taxes: A webpage appears regarding taxation.

- You'll find a lot of options in green.

- Search for the option Other taxes.

- Tap on the option.

Step 3: Check the taxes: A new web page will open which will have information regarding Taxation.

Scroll down the article to locate the heading Taxes in tourist facilities. You can directly jump into this section from the sections mentioned on the left side of the page.

- This portion mentions the taxes levied on various tourist facilities.

As a tourist, you have a certain responsibility towards a place you are visiting. Hence, you need to pay the taxes. Tourist taxes are advantageous and can raise the destination's worth. Follow the above steps to learn about the taxes in tourist facilities in UAE.

FAQs

How much does Dubai's tourist tax cost?

There is a municipal charge of 7%, a 10% property service fee, and 7 to 20 AED is the "Tourism Dirham Fee" per room, each night. However, this tax changes depending upon the hotel. AED is the currency of Dubai.

Which kinds of taxes are levied in the UAE?

Individuals are not subject to income tax in the UAE. However, it imposes corporate taxes on international banks and energy firms. Specific products that are particularly damaging to the environment or human health are subject to excise taxes. Most goods and services are subject to value-added tax.

Are Indians Exempt from Tax in Dubai?

You are not required to pay income tax in the UAE if you are an NRI. According to the UAE-India Double Taxation Avoidance Agreement, you are not required to pay any taxes on your UAE income in India as well.

Are foreigners exempt from taxes in the UAE?

Most of the time, American ex-pats who live or work overseas must annually take into account both their American and host nation taxes. You will only need to file taxes on the U.S. side if you are an American living in the UAE because there is no income tax there. Using the overseas earned income exclusion, you might be able to reduce your U.S. tax obligation.

Without a job, is it possible to survive in the UAE?

Without work, you can obtain a UAE visa. There has been notable growth in the visa program, as declared by the UAE government. Even though the bulk of ex-pats—roughly 85% of the country's population—work as employees there and need a work visa to reside here. If you want you can get a job in Dubai.

The additional FAQs will be quite helpful for understanding better.

Related Article

- How to Check The Fact Sheet of UAE

- How to Register for Vat in UAE

- What Are the Documents Required for Cancelling Residence Visa in UAE

- How to Apply for Long Term Tourist Visa in UAE

- How to Get the Benefits of Residence Visa in UAE

- How to Apply for Remote Work Visa in UAE

- How to View Visa Rules in UAE

- How to Find Out the Eligibility for Golden Visa in UAE

- How to Check The Conditions for Tourists to Claim Their VAT Refunds in UAE

- How to Get Lost Item Certificate in UAE

- More Articles...