- UAE

- cancel work permit

- check validity uae

- get equivalency certificate

- lift travel ban

- complain domestic violence

- renew residence visa

- apply transfer residency

- get conditions getting

- apply emirates id card

- business masdar free zone

- tax number uae

- tourist facilities uae

- entry permit uae

- private sector uae

- residency visa uae

- running business uae

- how to apply for retirement golden visa in uae

- fact sheet uae

- register vat uae

- cancelling visa uae

- tourist visa in uae

- residence visa uae

- remote visa uae

- visa rules uae

- eligibility golden visa uae

- vat refunds uae

- item certificate uae

- transit visa uae

- work permit in uae

- traffic fine uae

- work permit uae

- golden visa uae nurses

- golden visa uae

- status amendment uae

- vaccination information uae

- disciplinary penalties uae

- vat registration uae

- get internships uae

- tourist visa uae

- extend visa uae

- emergency contacts uae

- visa validity uae

- how to check fine in uae

- entry tourist visa uae

- golden visa in uae

- permit in uae

- zone complaint uae

- establishment card uae

- foreign employees uae

- online business uae

- covid result online uae

- vaccination certificate uae

- shopping site uae

- e visa uae

- labor complaint uae

- new work permit uae

- labor contract uae

- electricitywater bill uae

- recruitment service uae

- list holidays uae

- domestic helpers uae

- uae driving license

- overstay fine uae

- professional jobs uae

- get pcc uae

- excise tax uae

- register trademark uae

- complain salary delay uae

- get icv certificate uae

- apply business p.o. box in uae

- apply for patent uae

- check coronavirus helpline uae

- lawyer uae

- how to report cybercrime in uae

- terminate employee uae

- uae company status

- company vat uae

- travel ban uae

- certificate attested uae

- buy data etisalat uae

- uid number uae

- visa details uae

- uae passport

- renew passport uae

- unemployment insurance uae

- annual leave uae

- tourist visa application uae

- visa expiry date uae

- file case uae

- complain company uae

- credit card uae

- police case uae

- remove travel ban uae

- overtime uae

- short term visa uae

- visa fine uae

- cehicle details uae

- job uae government

- higher education uae

- invest in uae

- health insurance policy uae

- abu dhabi's pension uae

- compute gratuity uae

- international driving license uae

- electricity water bills uae

- check travel ban in uae

- cancel uae residence visa

- education budget uae

- uae tourism

- check uae attestation

- check criminal case uae

- check vehicle details uae

- uae visit visa validity

- calculate benefit pension uae

- students code conduct

- apply for scholarships

- calculate gratuity uae

- abu dhabi visa

- pcc abu dhabi

- check traffic fines

- visa ban status

- uae visa status

- certificate attestation uae

- emirates id status

How to Apply for Credit Card in UAE

After arriving in the UAE, you might need to apply for a credit card to make purchases. Travel, entertainment and retail privileges are just a few perks that credit cards offer. The banks offer credit cards that are customized for each customer's necessities and expenditures. Some cards offer cash backs, others also give free access to airport lounges and other perks. The banks of UAE have lenient criteria for procuring a credit card.

Furthermore, Check out how to get a job in Dubai.

Credit Card In UAE

Apply for credit card in UAE in 3 easy steps.

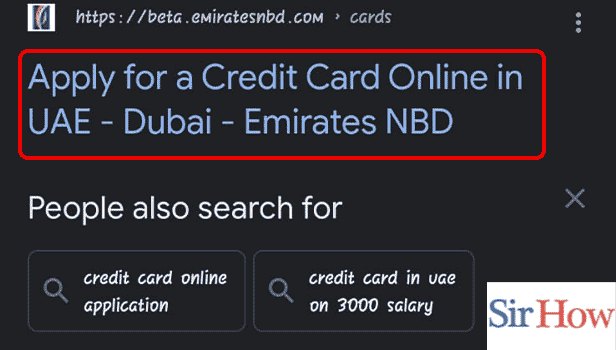

Step 1: Go to Apply credit card page: Firstly, open your device and visit your search engine and then type in the link u.ae apply credit card and then click on Search.

Then page for applying for a credit card opens up.

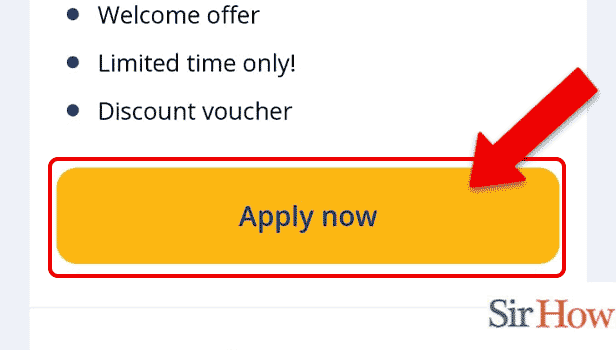

Step 2: Choose credit card and tap on apply: When you click on Search, a page opens up that shows a range of credit card types.

- Then locate the credit that you want and them tap on Apply Now below it.

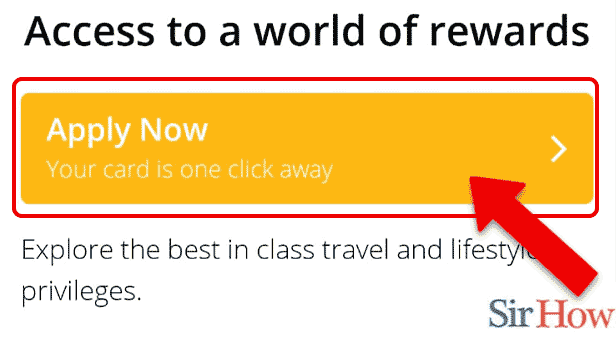

Step 3: Tap on apply now: In the page that opens up, add your information.

- After adding the information submit it.

- Finally, click on Apply Now to issue your credit card.

If you are in UAE, you might need to have a credit card for making necessary purchases. Once you follow the simple steps you can issue a credit card for yourself easily. Issuing a credit card is only a handful of clicks away.

FAQs

Is it possible to get a credit card in UAE with a salary AED 3000?

No banks in the UAE that offer credit cards for salaries of AED 3000. The minimum wage to procure a credit card in UAE is AED 5000. When used wisely, credit cards are the most useful instrument.

Is there a minimum salary to get a ADCB credit card?

To be eligible to apply for an ALL - ADCB Infinite Credit Card, you must have a minimum monthly income of AED 40,000. In addition, each supplemental credit card will have an annual cost of AED 262.50 (including VAT).

What is the minimum salary to get a loan in UAE?

If you want to get a loan in UAE, it requires for you to have a minimum salary. In case of recognized enterprises, the required minimum monthly pay is AED 7,000; for unapproved companies, it is AED 10,000.

Can I get a credit card after receiving my first salary?

After getting your first job, a credit card may be the best financial tool you can use to control your spending. If you are applying for an HDFC Bank Freedom Credit Card, it will allow you to take advantage of a number of benefits, including CashPoints on all purchases, fuel fee waivers, zero lost card responsibility, and much more.

Does any bank in UAE let you apply for a credit card with low salary?

Noor Bank adheres to Islamic banking principles. The bank provides a Wealth Credit Card that has no minimum income restriction and an annual charge of AED 1,000. In addition, this credit card is simple to apply for and accepts applicants with a minimum salary of AED 2500 or less.

Here's how you can check your UAE visa ban status.

These answered FAQs will help you to acquire an array for additional information about credit cards, loans and more in the UAE.

Related Article

- How to Apply for Multiple Entry Tourist Visa in UAE

- How to Track Application for Golden Visa in UAE

- How to Cancel a Temporary Work Permit in UAE

- How to Register a Free Zone Complaint in UAE

- How to Issue Establishment Card in UAE

- What Are the Basic Rules to Sponsor Foreign Employees in UAE

- How to Start Online Business in UAE

- How to Check Covid Test Result Online in UAE

- How to Get Vaccination Certificate in UAE

- How to Complain Against Online Shopping Site in UAE

- More Articles...