- UAE

- cancel work permit

- check validity uae

- get equivalency certificate

- lift travel ban

- complain domestic violence

- renew residence visa

- apply transfer residency

- get conditions getting

- apply emirates id card

- business masdar free zone

- tax number uae

- tourist facilities uae

- entry permit uae

- private sector uae

- residency visa uae

- running business uae

- how to apply for retirement golden visa in uae

- fact sheet uae

- register vat uae

- cancelling visa uae

- tourist visa in uae

- residence visa uae

- remote visa uae

- visa rules uae

- eligibility golden visa uae

- vat refunds uae

- item certificate uae

- transit visa uae

- work permit in uae

- traffic fine uae

- work permit uae

- golden visa uae nurses

- golden visa uae

- status amendment uae

- vaccination information uae

- disciplinary penalties uae

- vat registration uae

- get internships uae

- tourist visa uae

- extend visa uae

- emergency contacts uae

- visa validity uae

- how to check fine in uae

- entry tourist visa uae

- golden visa in uae

- permit in uae

- zone complaint uae

- establishment card uae

- foreign employees uae

- online business uae

- covid result online uae

- vaccination certificate uae

- shopping site uae

- e visa uae

- labor complaint uae

- new work permit uae

- labor contract uae

- electricitywater bill uae

- recruitment service uae

- list holidays uae

- domestic helpers uae

- uae driving license

- overstay fine uae

- professional jobs uae

- get pcc uae

- excise tax uae

- register trademark uae

- complain salary delay uae

- get icv certificate uae

- apply business p.o. box in uae

- apply for patent uae

- check coronavirus helpline uae

- lawyer uae

- how to report cybercrime in uae

- terminate employee uae

- uae company status

- company vat uae

- travel ban uae

- certificate attested uae

- buy data etisalat uae

- uid number uae

- visa details uae

- uae passport

- renew passport uae

- unemployment insurance uae

- annual leave uae

- tourist visa application uae

- visa expiry date uae

- file case uae

- complain company uae

- credit card uae

- police case uae

- remove travel ban uae

- overtime uae

- short term visa uae

- visa fine uae

- cehicle details uae

- job uae government

- higher education uae

- invest in uae

- health insurance policy uae

- abu dhabi's pension uae

- compute gratuity uae

- international driving license uae

- electricity water bills uae

- check travel ban in uae

- cancel uae residence visa

- education budget uae

- uae tourism

- check uae attestation

- check criminal case uae

- check vehicle details uae

- uae visit visa validity

- calculate benefit pension uae

- students code conduct

- apply for scholarships

- calculate gratuity uae

- abu dhabi visa

- pcc abu dhabi

- check traffic fines

- visa ban status

- uae visa status

- certificate attestation uae

- emirates id status

How to Register Company for VAT in UAE

A company that has registered under the VAT law is recognized by the government as a provider of Goods and Services. It is qualified to charge consumers VAT and submit it to the government. Thus, if you want to know how to register company for VAT in UAE read this article to know how to do it.

You can also change ECR passport into ECNR in UAE from here.

How to Register for VAT in UAE

Register company for VAT in UAE in 3 easy steps.

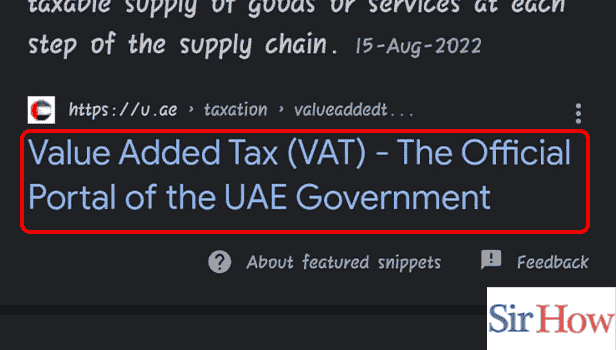

Step 1: Go to VAT page: The first step is to open your device, either your phone or your desktop.

- Then open your search engine and type in the link u.ae vat to open the VAT page.

- Then click on the Search button.

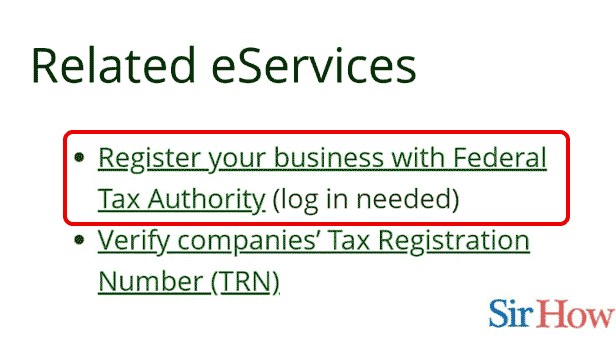

Step 2: Tap on register your business: Once you click on Search, a new page opens up.

- Then find the subsection saying Related eServices.

- Then tap on the first link which is Register your business with Federal Tax Authority.

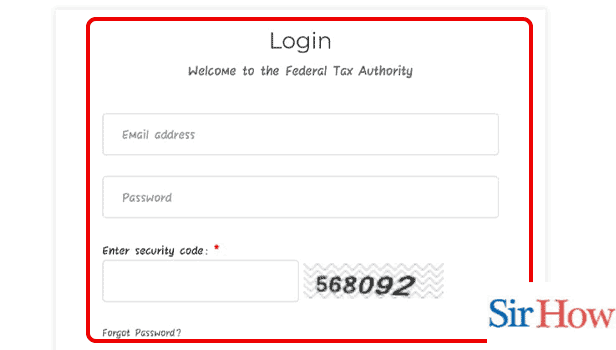

- Step 3: Login to register: Then a login appears after you click on the link.

- Enter you Email address and your password. Then enter the security code too.

- Then finally tap on login.

Once you have registered the company for VAT in UAE, the company can charge for VAT and submit it to the government. It is important to register a company for VAT. You just have to follow the steps in this article to do it.

FAQs

At what time should the company register for VAT?

If your company is registered in the UAE and has an annual turnover of more than AED 375,000, you must register for VAT.

Is anybody exempted from VAT in UAE?

Generally speaking, VAT exemptions are provided in the UAE for a variety of financial services, residential construction, the supply of bare land, local travelers, and more. The exact requirements outlined in the UAE VAT Act must be met to deem a supply to be exempt from VAT.

Is there a VAT limit for small companies?

If your annual revenue is under £85,000.00, you can elect to register for VAT ("voluntary registration"). Any VAT you owe HMRC (HM Revenue and Customs) must be paid as of the date of registration. You do not need to register for VAT if everything you sell is VAT-exempt.

Can a newly founded company file for VAT?

You must register for VAT if your annual revenue exceeds £85,000 or you anticipate it will. Additionally, some businesses will need to register if they wish to sell specific products in specified markets. You can find more information on the registration deadline.

You can also calculate benefit and pension salary in UAE with ease.

Should I pay VAT if I run a small business?

The majority of firms must submit quarterly VAT returns. Normally, they must be presented, and paid for within one month and seven days following the conclusion of the pertinent period.

What turnover is necessary to register for VAT?

If the value of taxable supplies made or to be made in any successive 12-month period exceeds 1 million, a person must register for VAT.

These FAQs will hopefully be of help to you if you want to gather more information about VAT registration in UAE companies.

Related Article

- How to Calculate Overtime in UAE

- How to Apply for Short-Term Transit Visa in UAE

- How to Check Visit Visa Fine in UAE

- How to Check Vehicle Details in UAE

- How to Get a Job in UAE Government

- How to Find Higher Education Institutes in UAE

- How to Invest in UAE

- How to Check Health Insurance Policy Online in UAE

- How to Check Abu Dhabi's Pension Status in UAE

- How to Compute Gratuity in UAE

- More Articles...