- UAE

- cancel work permit

- check validity uae

- get equivalency certificate

- lift travel ban

- complain domestic violence

- renew residence visa

- apply transfer residency

- get conditions getting

- apply emirates id card

- business masdar free zone

- tax number uae

- tourist facilities uae

- entry permit uae

- private sector uae

- residency visa uae

- running business uae

- how to apply for retirement golden visa in uae

- fact sheet uae

- register vat uae

- cancelling visa uae

- tourist visa in uae

- residence visa uae

- remote visa uae

- visa rules uae

- eligibility golden visa uae

- vat refunds uae

- item certificate uae

- transit visa uae

- work permit in uae

- traffic fine uae

- work permit uae

- golden visa uae nurses

- golden visa uae

- status amendment uae

- vaccination information uae

- disciplinary penalties uae

- vat registration uae

- get internships uae

- tourist visa uae

- extend visa uae

- emergency contacts uae

- visa validity uae

- how to check fine in uae

- entry tourist visa uae

- golden visa in uae

- permit in uae

- zone complaint uae

- establishment card uae

- foreign employees uae

- online business uae

- covid result online uae

- vaccination certificate uae

- shopping site uae

- e visa uae

- labor complaint uae

- new work permit uae

- labor contract uae

- electricitywater bill uae

- recruitment service uae

- list holidays uae

- domestic helpers uae

- uae driving license

- overstay fine uae

- professional jobs uae

- get pcc uae

- excise tax uae

- register trademark uae

- complain salary delay uae

- get icv certificate uae

- apply business p.o. box in uae

- apply for patent uae

- check coronavirus helpline uae

- lawyer uae

- how to report cybercrime in uae

- terminate employee uae

- uae company status

- company vat uae

- travel ban uae

- certificate attested uae

- buy data etisalat uae

- uid number uae

- visa details uae

- uae passport

- renew passport uae

- unemployment insurance uae

- annual leave uae

- tourist visa application uae

- visa expiry date uae

- file case uae

- complain company uae

- credit card uae

- police case uae

- remove travel ban uae

- overtime uae

- short term visa uae

- visa fine uae

- cehicle details uae

- job uae government

- higher education uae

- invest in uae

- health insurance policy uae

- abu dhabi's pension uae

- compute gratuity uae

- international driving license uae

- electricity water bills uae

- check travel ban in uae

- cancel uae residence visa

- education budget uae

- uae tourism

- check uae attestation

- check criminal case uae

- check vehicle details uae

- uae visit visa validity

- calculate benefit pension uae

- students code conduct

- apply for scholarships

- calculate gratuity uae

- abu dhabi visa

- pcc abu dhabi

- check traffic fines

- visa ban status

- uae visa status

- certificate attestation uae

- emirates id status

How to Register for Vat in UAE

Businesses in the UAE that generate more than AED 375,000 in revenue are required to voluntarily register for VAT. The Federal Tax Authority has opened its site for online VAT registration. The FTA has already stated the deadlines based on the annual revenue of the enterprises, and the registration process will be carried out in stages. It's crucial for businesses to understand how to apply for VAT registration and the degree of information needed to finish the online registration procedure. Let's register for VAT in UAE now.

Step by step VAT Registration process

Register for VAT in UAE in 6 steps

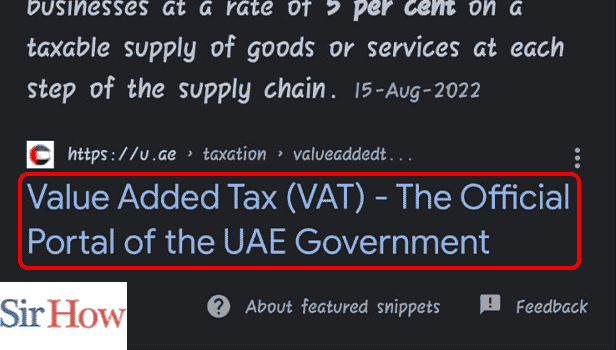

Step 1: Go to the u.ae vat page: To begin with, you have to first search for the VAT registration page. You can also click the link that is given to directly open the page.

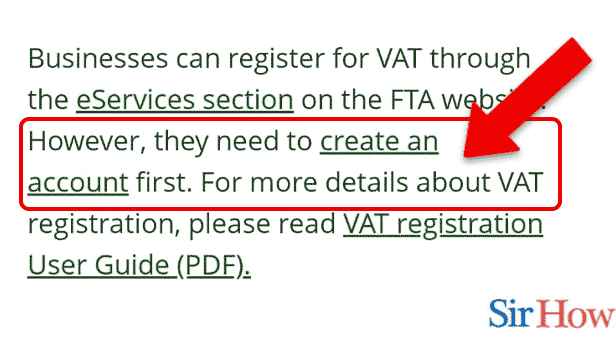

Step 2: Tap on create an account: Next, you will find an account creation option. You have to click on it to proceed.

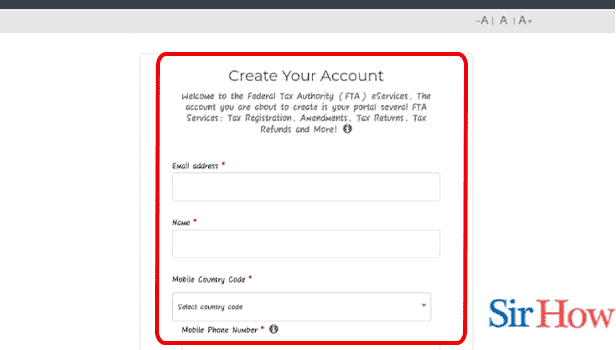

Step 3: Create your account: Your third step is to create an account. For that, you have to fill in all the blanks given there with the correct information. The red marks on the top indicate some information that is mandatory to fill in.

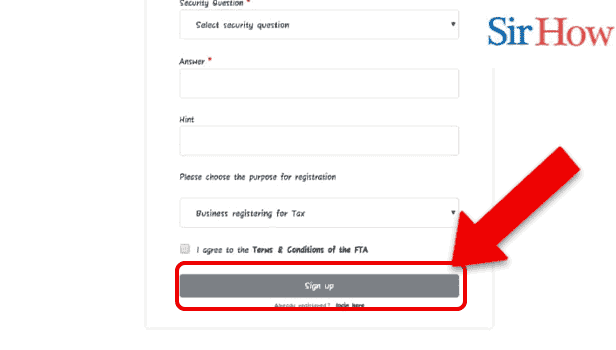

Step 4: Tap on sign up option: After filling up the boxes, you have to tap on the "sign up" option. This way you have now created your account.

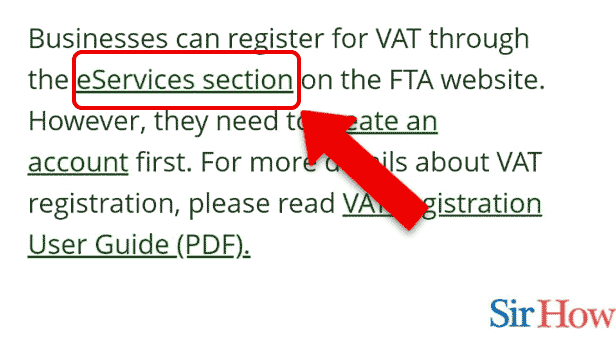

Step 5: Tap on the eServices section: Here, click on the "eServices" option.

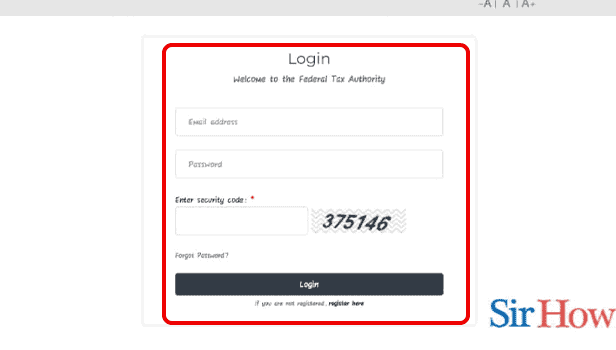

Step 6: Login the details: Lastly, log in to view the details. For that, you have to fill up the necessary boxes. After that, click the "login" option.

Thus, you can register now on your own. Additionally, you can also get PCC from UAE.

FAQs

Can I register for VAT in the UAE if I have no turnover?

If your company is registered in the UAE and your annual turnover exceeds AED 375,000, you must register for VAT.

Can I set up my own VAT registration?

Online registration for VAT is frequently possible. To register for VAT, you need a Government Gateway user ID and password. When you sign in for the first time, you can create a user ID if you don't already have one. A VAT online account is also created when you register for VAT.

To register for VAT, do you need a bank account?

You'll need the following to complete your VAT registration: contact information about your company. Financial information. distinct tax reference number.

How soon can I be registered for VAT?

The average time for the VAT registration process is 10 to 14 days. This period of time allows for the processing of about 70% of applications.

What is the cost of failing to file VAT?

When a person (natural or legal) fails to pay the tax due until the date provided in the law or until the date stipulated in any notification by the Commissioner, a monetary punishment of 5% is applied (on the tax due).

These briefly explained questions are very useful, and you must read them. Also, you can check disciplinary penalties in UAE.

Related Article

- How to Get a Job in UAE Government

- How to Find Higher Education Institutes in UAE

- How to Invest in UAE

- How to Check Health Insurance Policy Online in UAE

- How to Check Abu Dhabi's Pension Status in UAE

- How to Compute Gratuity in UAE

- How to Get International Driving license in UAE

- How to Pay Electricity and Water Bills in UAE

- How to Check Travel Ban in UAE

- How to Cancel UAE Residence Visa Online

- More Articles...