- UAE

- cancel work permit

- check validity uae

- get equivalency certificate

- lift travel ban

- complain domestic violence

- renew residence visa

- apply transfer residency

- get conditions getting

- apply emirates id card

- business masdar free zone

- tax number uae

- tourist facilities uae

- entry permit uae

- private sector uae

- residency visa uae

- running business uae

- how to apply for retirement golden visa in uae

- fact sheet uae

- register vat uae

- cancelling visa uae

- tourist visa in uae

- residence visa uae

- remote visa uae

- visa rules uae

- eligibility golden visa uae

- vat refunds uae

- item certificate uae

- transit visa uae

- work permit in uae

- traffic fine uae

- work permit uae

- golden visa uae nurses

- golden visa uae

- status amendment uae

- vaccination information uae

- disciplinary penalties uae

- vat registration uae

- get internships uae

- tourist visa uae

- extend visa uae

- emergency contacts uae

- visa validity uae

- how to check fine in uae

- entry tourist visa uae

- golden visa in uae

- permit in uae

- zone complaint uae

- establishment card uae

- foreign employees uae

- online business uae

- covid result online uae

- vaccination certificate uae

- shopping site uae

- e visa uae

- labor complaint uae

- new work permit uae

- labor contract uae

- electricitywater bill uae

- recruitment service uae

- list holidays uae

- domestic helpers uae

- uae driving license

- overstay fine uae

- professional jobs uae

- get pcc uae

- excise tax uae

- register trademark uae

- complain salary delay uae

- get icv certificate uae

- apply business p.o. box in uae

- apply for patent uae

- check coronavirus helpline uae

- lawyer uae

- how to report cybercrime in uae

- terminate employee uae

- uae company status

- company vat uae

- travel ban uae

- certificate attested uae

- buy data etisalat uae

- uid number uae

- visa details uae

- uae passport

- renew passport uae

- unemployment insurance uae

- annual leave uae

- tourist visa application uae

- visa expiry date uae

- file case uae

- complain company uae

- credit card uae

- police case uae

- remove travel ban uae

- overtime uae

- short term visa uae

- visa fine uae

- cehicle details uae

- job uae government

- higher education uae

- invest in uae

- health insurance policy uae

- abu dhabi's pension uae

- compute gratuity uae

- international driving license uae

- electricity water bills uae

- check travel ban in uae

- cancel uae residence visa

- education budget uae

- uae tourism

- check uae attestation

- check criminal case uae

- check vehicle details uae

- uae visit visa validity

- calculate benefit pension uae

- students code conduct

- apply for scholarships

- calculate gratuity uae

- abu dhabi visa

- pcc abu dhabi

- check traffic fines

- visa ban status

- uae visa status

- certificate attestation uae

- emirates id status

How to Register for Excise Tax in UAE

An excise tax is a type of indirect tax levied on the sale of a specific item. Products that are damaging to people or the environment are subject to excise tax. The main goal of the excise tax is to limit hazardous behaviors by reducing the consumption of those specific commodities. If you want you can look at the linked article and know how to start a business in Dubai. Now, let's look at the steps to register for excise tax in UAE.

Excise Tax Registration in the UAE

Register For Excise Tax in UAE in 4 Easy Steps

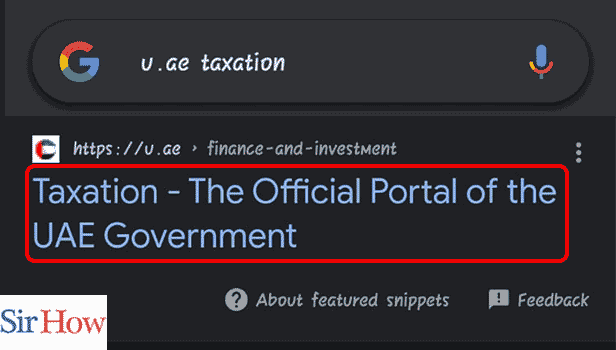

Step 1: Go to the UAE taxation page: As the first step, you need to go to the UAE taxation page. To go copy and paste the link into the browser. https://u.ae/en/information-and-services/finance-and-investment/taxation

- Then, tap on the search button.

- Otherwise directly, click on the link from here to visit the Taxation page.

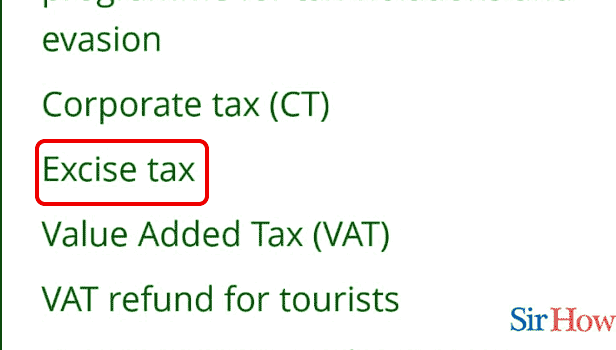

Step 2: Tap on excise tax: A webpage appears regarding taxation.

- You’ll find a lot of options in green.

- Search for the option Excise tax.

- Tap on the option.

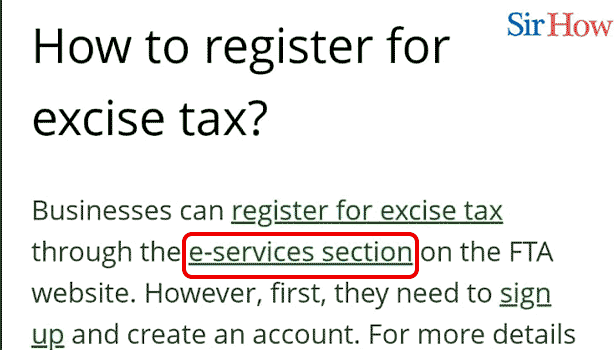

Step 3: Tap on the e-services section: A new page will open. Scroll down the article to locate the heading "How to register for excise tax?"

- Once, you locate the heading, click on the e-services section link.

- You'll find the link on the second line itself.

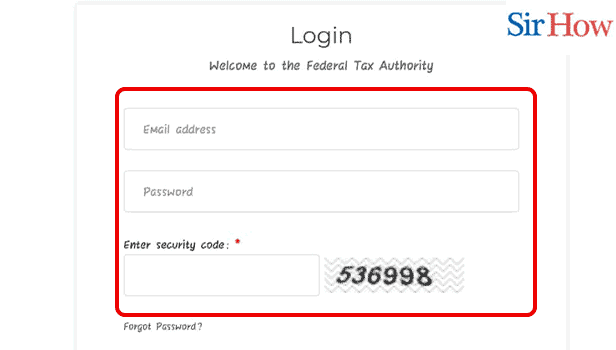

Step 4: Log in to register: A new window will appear which is the login page of the Federal Tax Authority of UAE.

- Enter your correct email address and password to log in.

- Click on the register here, if you haven't registered before.

If the excise tax is not paid in a timely manner a demand bill is issued. In that case, you will have to pay the tax as well as interest as the late fee. Hence, it is advisable to pay the excise tax on time.

FAQs

In the UAE, how do I pay the excise tax?

Registered firms must pay their owed taxes online through the Federal Tax Authority's website alone, using either an e-Dirham payment method or a credit card, using e-Debit, using a local transfer - bank transfer, or maybe through an international bank transfer.

What is the excise duty procedure?

The manufacturing of products is subject to the payment of excise duty. It is imposed when items are being transferred out of the factory or warehouse for sale. Since excise duty is already there at the manufacturing time, it is not necessary to impose it again during the actual sale of products.

Who has to register for the UAE excise tax?

Any company that imports, produces, or stockpiles excise items in the United Arab Emirates should register for excise tax.

What distinguishes the VAT from the excise duty?

Value Added Tax is known as VAT. While Central Excise Tax is imposed by the federal government, VAT is intended for State governments. India imposes a central excise tax on the production of excisable commodities. However, VAT is assessed when items are sold within the state.

Is investing in the UAE a wise idea?

Yes, it is a wise idea to invest in UAE. There are 100% foreign ownership in 13 sectors and 122 economic activities. 100% of profits are returned. An efficient visa system that permits 10-year renewable residency permits. High levels of liquidity, competitive borrowing prices, and a robust banking system.

Taxes are important for an economy to sustain and work smoothly. Hence, read the entire article to register for your excise tax in the UAE and also go through the additional information.

Related Article

- How to Apply for Golden Visa UAE for Nurses

- How to Apply for Golden Visa UAE

- How to Apply for Status Amendment in UAE

- How to Update Vaccination Information in UAE

- How to Check Disciplinary Penalties in UAE

- How to Apply For Vat Registration in UAE

- How to Get Internships in UAE

- How to Apply for Tourist Visa in UAE

- How to Extend Visit Visa in UAE

- How to Get Emergency Contacts in UAE

- More Articles...