- sirhow

- title case

- check huroob status

- check computer information

- delete snapchat messages

- profile picture microsoft teams

- redglitch filter instagram

- protect sheets amp ranges

- check passport status

- check cibil score online

- check android specs

- check computer age

- write article on sirhow

- celebrate eid

- career in writing

- help poor people

- help poor peoples

- use pocket wifi

- safe during earthquake

- watch live cricket

How to Check CIBIL Score Online Free

Through this article, you will learn How to Check Cibil Score Online Free in 7 easy steps.

CIBIL plays a major role in loan approval processes if you don't have enough money in your bank account. A bank will first check your credit score and credit report as soon as you fill and submit your loan application form and have the power to rightly reject your loan application based upon your credit score. Therefore, it is important to check your CIBIL scores. Also, learn how to enquire about account balance in SBI bank account.

How to Verify CIBIL Score Online Free

Check CIBIL Score Online Free in 7 Easy Steps

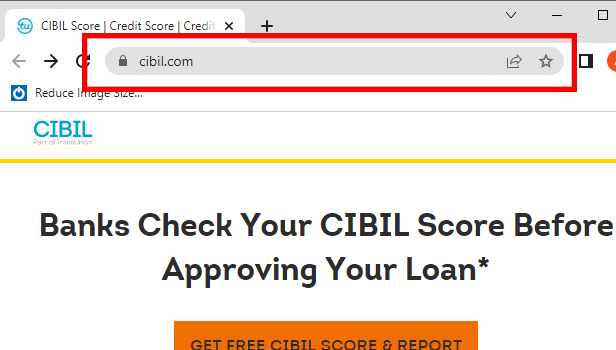

Step-1 Go To CIBIL Website: The first step you have to follow is to open your web browser Chrome or any.

Let's say chrome, then click on the search box located at the top of the screen and go to CIBIL's official website .i.e. https://www.cibil.com/

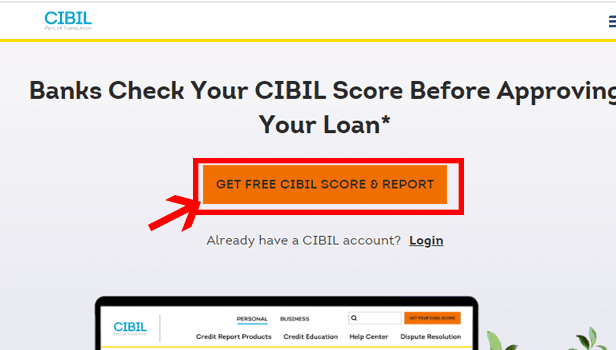

Step-2 Click 'Get your CIBIL Score': On the CIBIL institution's official website's home page you will see an option to check your CIBIL score for free under the heading. ' Banks Check Your CIBIL score before approving your loan.'

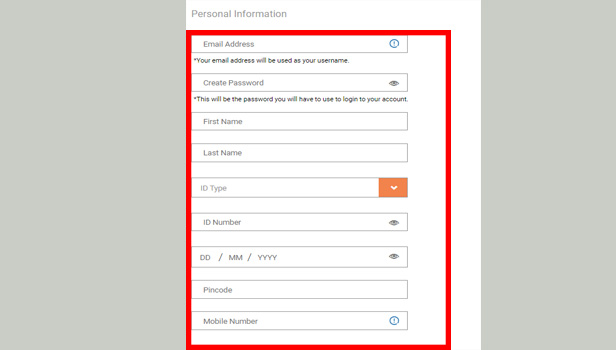

Step-3 Enter details: As a next step check your credit score and credit report. You have to enter some Personal Information to create an account on this site.

- Enter a valid Email address which will be then used as your username along with the strong password.

- You also have to enter your Name, ID Type, Pin code of the area you live and etc. as shown in the attached picture below.

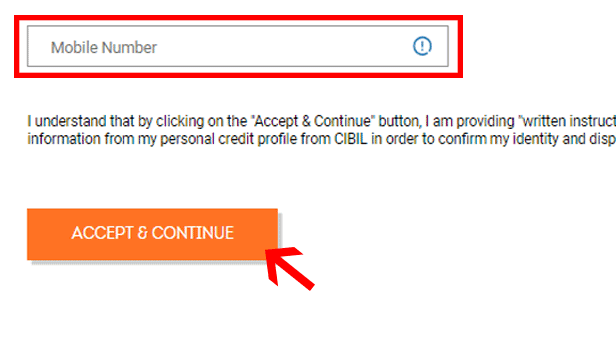

Step-4 Click on 'Accept and continue': Once you are done filling out your details move over to the next step:

- Enter a valid and active mobile number of 10 digits along with your area SD code.

- Then, tap on 'Accept and Continue.'

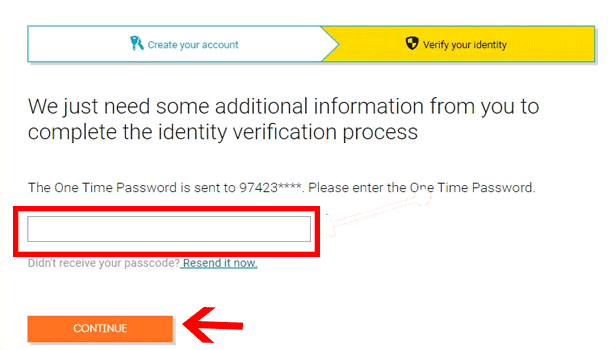

Step-5 Enter OTP: After you tap on 'Accept and continue as described in the previous step, you will get a Time Password on your entered mobile number to complete the identity verification process.

Enter the OTP you get through the message on your mobile and tap on 'Continue' to move further with the process.

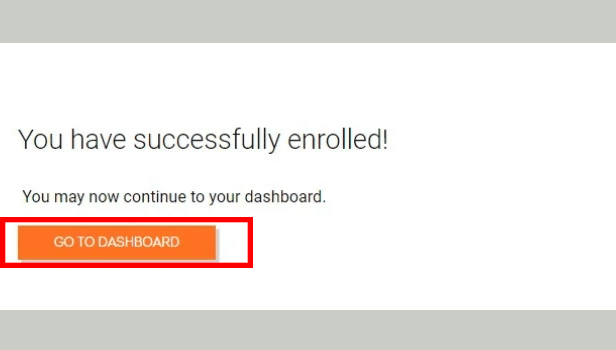

Step-6 Click 'Go to Dashboard': Once you enter the correct OTP, a message of 'You have successfully enrolled' will display on your screen.

Now you may continue with the process of checking your CIBIL score by going to your dashboard.

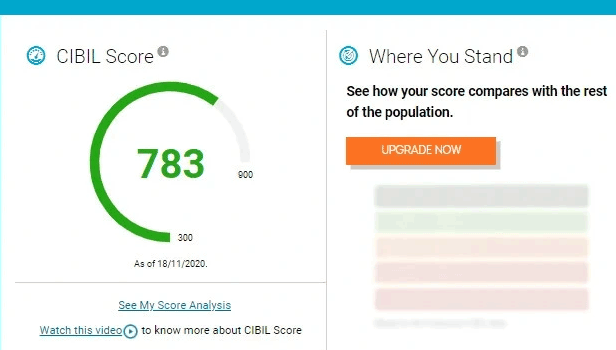

Step-7 Check CIBIL Score: When you come back to your dashboard, you can then check your CIBIL score. Find out if you are eligible for a loan from a bank or not.

And finally, you're done with the process of checking your CIBIL score.

FAQ

Why Is CIBIL Score Important To Know?

CIBIL plays a major role in loan approval processes. It decides if you are eligible for the loan. A bank you applied for a loan in will first check your credit score and credit report before accepting your loan application.

CIBIL credit scores are therefore the deciding factor for many banks when it comes to considering your loan application. The higher the score, the higher the chance your loan application will be approved and you will be granted a loan.

What Are The Advantages Of a Good CIBIL Score?

There are many advantages of a Good CIBIL score, some of them are listed below:

- Eligible for loan: A higher CIBIL score decides your eligibility for getting a loan from banks and also non-banking finance companies (NBFC).

- Discount on interest rate: With a high CIBIL score, you are in a position to negotiate for a better interest rate or a discount on the interest rate for your loan.

- Faster loan approval: A healthy CIBIL score paves the way for quicker loan approvals from lenders as your score speaks volumes about your financial status.

And many such advantages which all the way makes it important for you to check your CIBIL credit score.

How To Check Balance In SBI Bank Account?

If you want to add a beneficiary to the SBI account to transfer money to someone else's account. Then you need to check your account balance so follow the below-given steps to do so:

- First Put the ATM card in the designated slot.

- Then Enter your confidential 4-digit pin.

- From the screen of the ATM, Select ‘Balance Enquiry’ and you can see the account balance amount on the screen.

What Are The Steps To Apply For Loan In Banks?

There are 7 steps to applying for a Loan in banks:

- First, decide the amount of loan you need.

- Then, find a loan that’s right for you.

- Then, Look at what different lenders offer like discounts on the interest rates.

- You will then have to check the loan requirements and APR

- As a next step Compare lenders’ offers to choose the best one.

- Gather the documents you require to apply for a loan.

- Finally, Submit your loan application and finish the process of applying for a loan.

Does frequently checking your CIBIL score affect the score negatively?

Each time you make a loan application after you check your credit score, a credit score inquiry straight goes out to the credit rating agencies and these frequent inquiries can lower your credit score which will make it difficult for you to get a loan.