- Mumbai

- domicile certificate

- property tax mumbai

- admission mumbai university

- marriage certificate mumbai

- court marriage mumbai

- etribal maharashtra

- driving licence mumbai

- schengen visa mumbai

How to Pay Property Tax in Mumbai

Paying property tax is a mandatory obligation for property owners in Mumbai. It is a tax levied by the local government on real estate properties, which is used to fund various civic amenities and services in the city. Property tax payments are crucial for maintaining the basic infrastructure of the city, including roads, sewage systems, water supply, and other public services.

Pay property tax in Mumbai in 4 steps

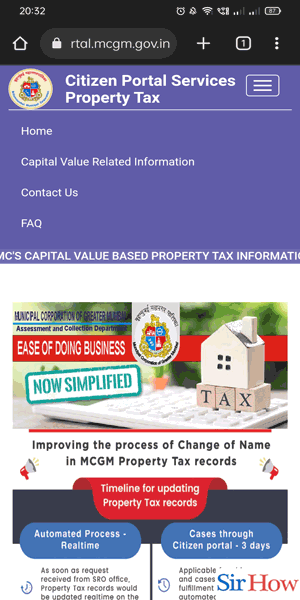

Step 1: Go to ptaxportal website - The first step is to visit the official PTAX portal website of the Municipal Corporation of Greater Mumbai (MCGM). The website is designed to make the payment of property tax easier for property owners in Mumbai.

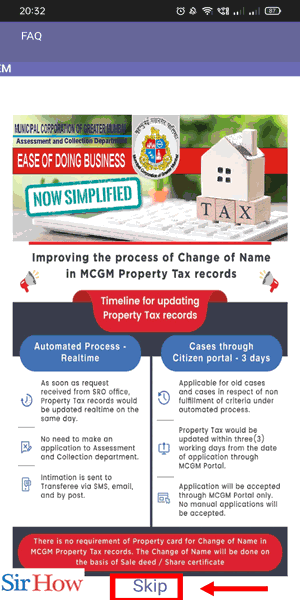

Step 2: Select skip - Once you have accessed the website, you will see a pop-up message. Click on the “Skip” button to proceed further.

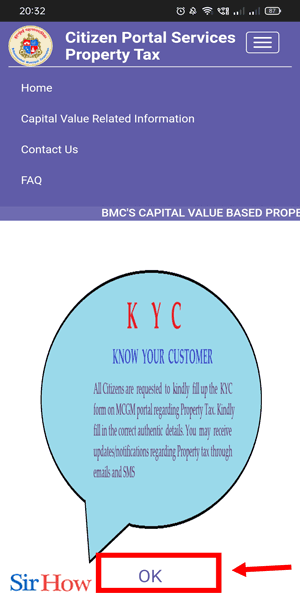

Step 3: Click on okay and accept - After skipping the pop-up message, you will be redirected to a new page. Read and accept the terms and conditions by clicking on the “Okay” button.

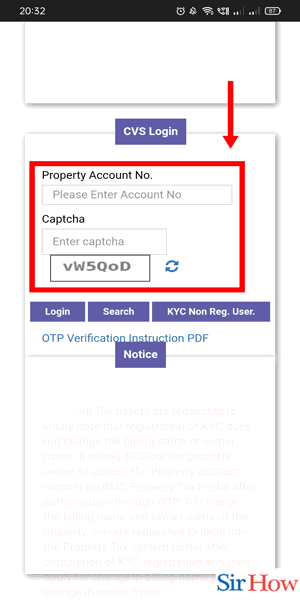

Step 4: Enter your details and proceed to pay - To proceed with the payment process, you will have to enter your property details, such as the property tax bill number, the property’s location, and the property’s zone. After entering these details, click on “Proceed to Pay.”

In conclusion, paying property tax is essential for the betterment of Mumbai city's infrastructure and civic amenities. The PTAX portal website has made it easier for property owners to pay their taxes online without the need to visit any physical offices. Following the above-mentioned steps, property owners can quickly pay their property tax in Mumbai without any hassle.

FAQ

- What is property tax, and why is it essential to pay it in Mumbai?

Property tax is a tax levied by the local government on real estate properties. It is essential to pay property tax as it is used to fund various civic amenities and services in the city, including roads, sewage systems, water supply, and other public services.

- How can I check my property tax dues in Mumbai?

To check your property tax dues in Mumbai, you need to visit the MCGM's official PTAX portal website and enter your property details. The portal will display your property tax bill and dues, which you can pay online.

- What are the consequences of not paying property tax in Mumbai?

Not paying property tax in Mumbai can result in penalties and legal action. The government can seize your property or impose a fine, making it challenging to sell or transfer ownership of the property.

- Can I pay my property tax offline in Mumbai?

Yes, you can pay your property tax offline in Mumbai by visiting the nearest Citizen Facilitation Center (CFC) or designated banks authorized by the MCGM.

- Can I pay my property tax in installments in Mumbai?

Yes, you can pay your property tax in installments in Mumbai. The MCGM allows taxpayers to pay their property tax dues in four installments during the financial year. However, you need to pay interest on the outstanding dues if you opt for this option.

Related Article

- How to get Domicile Certificate in Mumbai

- How to Get Online Admission in Mumbai University

- How to Obtain Marriage Certificate in Mumbai

- How to do Court Marriage in Mumbai

- How to Register Online on Etribal Maharashtra Website

- How to Get Learning and Permanent Driving Licence in Mumbai

- How to apply for Schengen visa in Mumbai

- More Articles...