- Paytm

- delete bank account

- find qr code

- earn cashback paytm

- login paytm forgot

- pay bwssb paytm

- pay bsnl landline

- pay upi payment

- recharge axis paytm

- recharge jiofi with paytm

- recharge tv paytm

- pay water bill

- refer friend paytm

- pay lic premium

- pay money paytm

- refund money google play

- refund money paytm

- book tatkal train

- buy fastag paytm

- buy paytm gold

- make paytm account

- pay using upi

- pay through credit

- recharge airtel fastag

- recharge fastag paytm

- check paytm coupons

- create paytm business

- call paytm mall

- buy truecaller premium

- pay act fibernet

- pay cesc bill

- pay lic paytm

- pay property tax

- buy google play gift card

- buy amazon voucher

- download paytm qr code

- download paytm invoice

- enable fingerprint paytm

- find movie ticket

- online payment through

- download paytm statement

- generate merchant paytm

- find scratch paytm

- increase paytm merchant

- know paytm balance

- logout paytm devices

- make credit card

- pay icici card

- recharge d2h through

- recharge hdfc fastag

- recharge data pack

- book ipl tickets

- book mumbai metro

- apply paytm swipe

- avail paytm postpaid

- activate paytm first

- see received money

- register paytm mall

- pay uppcl electricity

- pay kesco bill

- pay electricity bill

- pay igl bill

- pay manappuram gold

- pay bharat gas

- know paytm bank

- change merchant name

- check paytm number

- talk with customer

- chat in paytm

- redeem paytm first

- remove payment history

- see payment history

- send qr code

- update paytm app

- add money metrocard

- apply coupon paytm

- buy gift cards

- change paytm phone

- change paytm language

- create merchant id

- use paytm cashback

- pay paytm wallet

- send money paytm

- delete paytm

- install paytm

- money paytm wallet

- delete paytm account

- paytm wallet account

- fastag balance paytm

- upi pin ipaytm

- use paytm wallet money

- get paytm speaker

- find paytm upi id

- add bank account paytm

- bank account paytm

- change paytm upi id

- block someone paytm

- check paytm bank account number

- get loan paytm

- remove saved cards paytm

- activate offer in paytm

- flipkart using paytm

- how to check paytm offers

- received money paytm

- reactivate paytm account

- complain to paytm

- activate paytm postpaid

- play games paytm

- track paytm order

- paytm through email

- recharge paytm fastag

- use paytm postpaid

- deactivate paytm postpaid

- cibil score paytm

- deactivate fastag paytm

- credit card paytm

- paytm merchant account

- automatic payment paytm

- find vpa paytm

- paytm order id

- paytm notifications

- change passcode paytm

- credit money paytm

- delink aadhar paytm

- airtel dth paytm

- food from paytm

- book gas paytm

- how to create fd in paytm

- default paytm money

- paytm scan pay

- paytm shopping voucher

- internet recharge paytm

- paytm scratch card

- bike insurance paytm

- paytm debit card

- card bill paytm

- bhim upi paytm

- paytm first membership

- recharge hotstar paytm

- tdr on paytm

- pnr status paytm

- wishlist in paytm

- bank paytm wallet

- check passbook in paytm

- become paytm merchant

- create paytm link

- claim paytm insurance

- earn money paytm

- paytm bank account

- paytm qr code

- qr code whatsapp

- setup paytm lite

- request paytm bank statement

- complete kyc in paytm

- remove kyc from paytm

- check paytm kyc

- paytm wallet money to paytm bank

- get paytm refund

- paytm qr code shopkeepers

- cancel bus ticket in paytm

- transfer money paytm to phonepe

- paytm for business

- transfer money phonepe to paytm

- pay through qr scan paytm

- check paytm gold balance

- check paytm wallet number

- add credit card in paytm

- add money paytm wallet debit

- landline bill through paytm

- remove paytm contacts

- cancel an order on paytm

- verify email address paytm

- cancel train tickets paytm

- cancel flight ticket paytm

- add debit card in paytm

- check transaction id in paytm

- free recharge in paytm

- cancel movie tickets paytm

- open paytm bank account

- check paytm balance

- verify paytm account for kyc

- book train tickets paytm

- change email paytm

- apply paytm card

- get paytm statement

- remove bank acc. from paytm

- electricity bill receipt paytm

- pay traffic challan paytm

- transfer money bank to paytm

- paytm recharge history

- check bank balance in paytm

- add promo code paytm

- add money paytm wallet

- recharge jio with paytm

- check paytm transaction history

- change password paytm

- create paytm account

- check paytm limit

- create upi pin paytm

- check cashback paytm

- book bus tickets paytm

- transfer money paytm to bank account

- reset paytm password

- transfer money paytm to paytm

- add beneficiary paytm

- share personal qr paytm

- pay institution fees paytm

- verify mobile number paytm

- recharge metro card paytm

- check inbox on paytm

- enable/disable notifications paytm

- pay dth bill paytm app

- log out paytm app

- contact paytm for help

- change profile picture paytm

- change username on paytm app

- security setting paytm app

- book hotel room paytm

- book flight tickets paytm

- helpline number on paytm app

- pay datacard bill paytm app

- pay water bills paytm app

- recharge google play paytm

- update mobile number paytm

- invite on paytm app

- choose language paytm

- book movie tickets paytm

- recharge mobile paytm

- pay credit card bill paytm

- pay electricity bill paytm

- how to recharge paytm

How To Get Loan From Paytm

In today's fast-paced world, financial emergencies can arise anytime, leaving you in a state of distress. Traditional banks have stringent lending criteria and may take several days to process loan applications, which is not ideal in times of urgent need. This is where Paytm comes in as a convenient and hassle-free solution to help you meet your financial needs. With Paytm's easy-to-use loan services, you can get access to quick funds with minimal documentation and flexible repayment options. In this blog post, we will explore how to get a loan from Paytm and the benefits of using this platform for your borrowing needs.

Get loan option under profile tab: 7 Steps

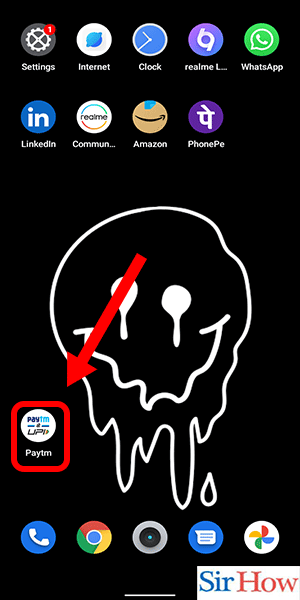

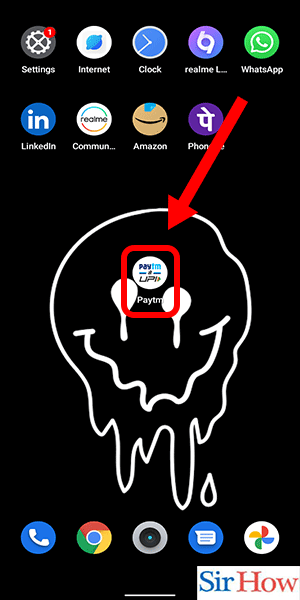

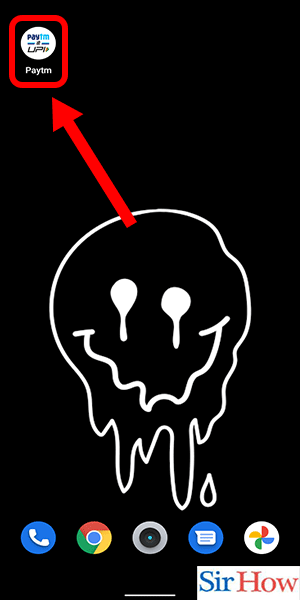

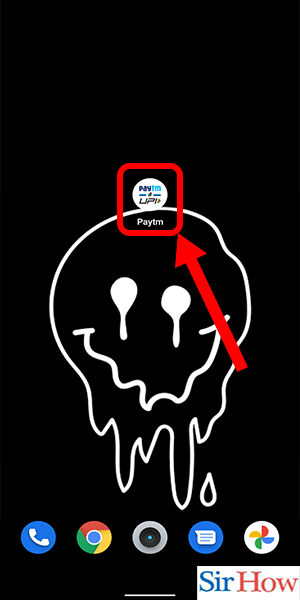

Step 1: Open paytm app - Ensure that you have the latest version of the Paytm app installed on your mobile device.

- Open the Paytm app by tapping on its icon on your home screen.

- If you don't have an account, you'll need to sign up for one first.

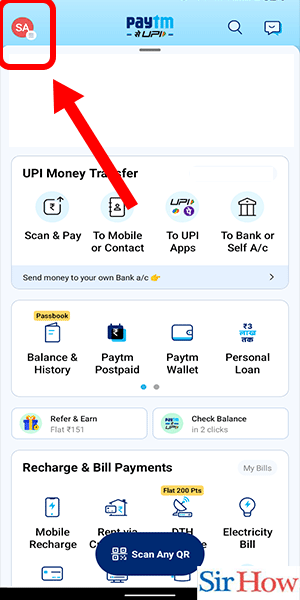

Step 2: Tap on profile icon - Look for the profile icon located at the top left-hand corner of the screen.

- Tap on it to access your account settings.

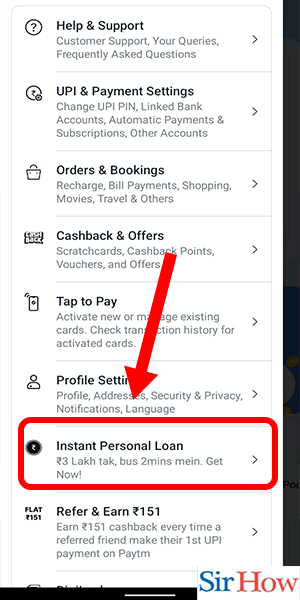

Step 3: select 'instant personal loan' - Scroll down until you see the "Instant Personal Loan" option and tap on it.

- You will be directed to a new page.

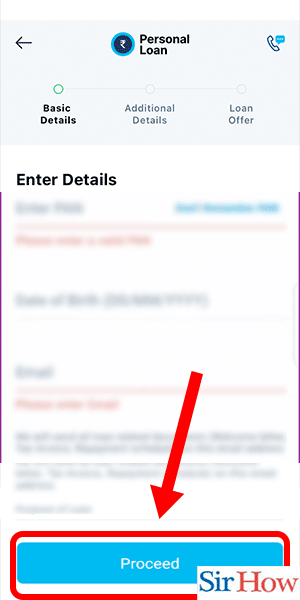

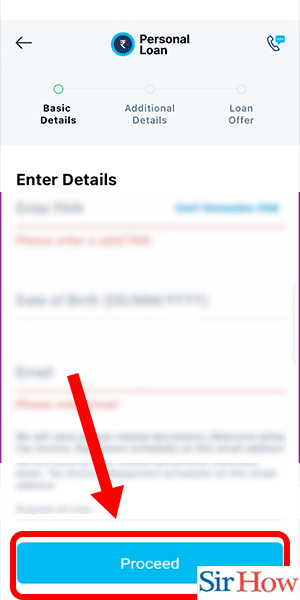

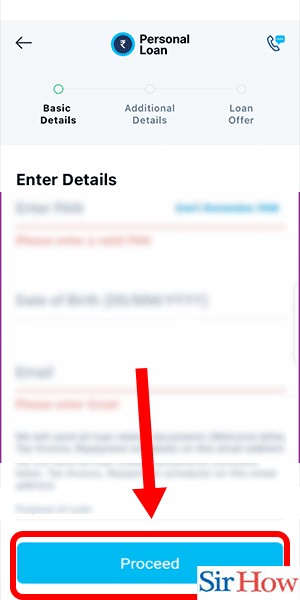

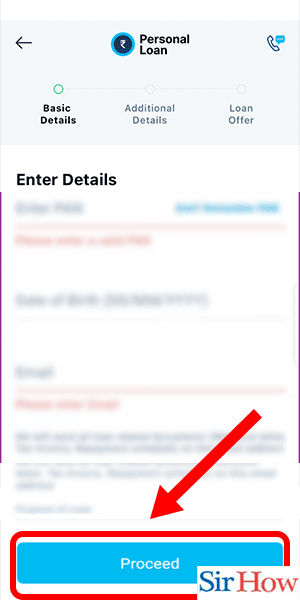

Step 4: Enter details & tap on proceed - Fill out the required details in the application form, including your personal information, contact information, and loan amount.

- Once you have filled in all the necessary details, tap on the "Proceed" button to move on to the next step.

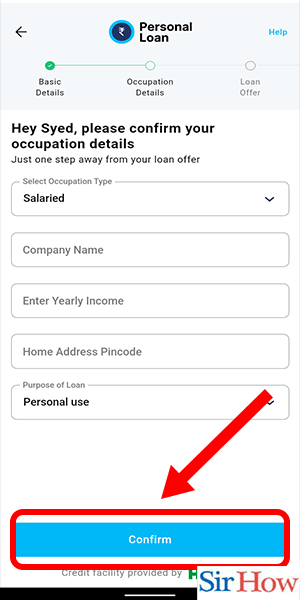

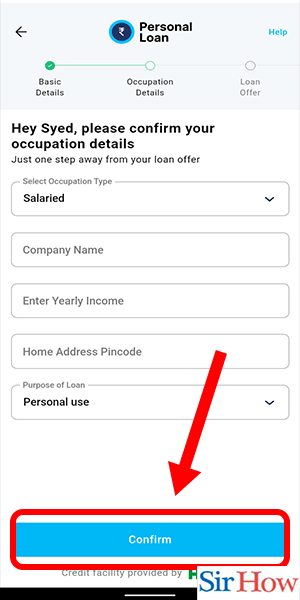

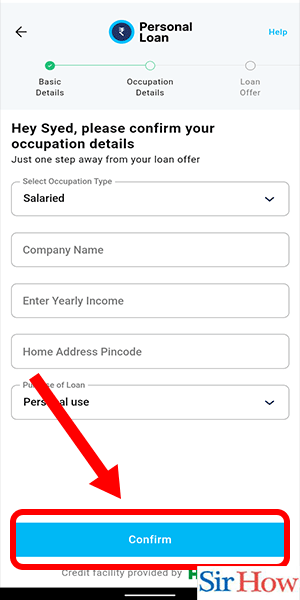

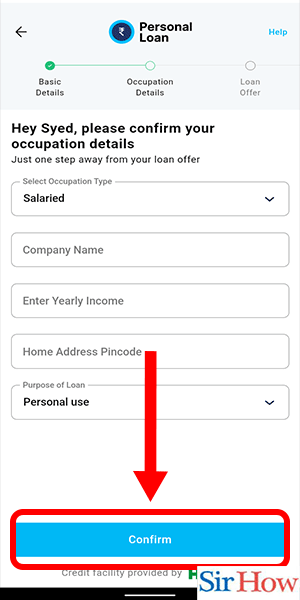

Step 5: Enter occupational details & tap on confirm - Enter your occupational details, including your current employment status, job title, and monthly income.

- Verify that all the information you have provided is accurate before tapping on the "Confirm" button.

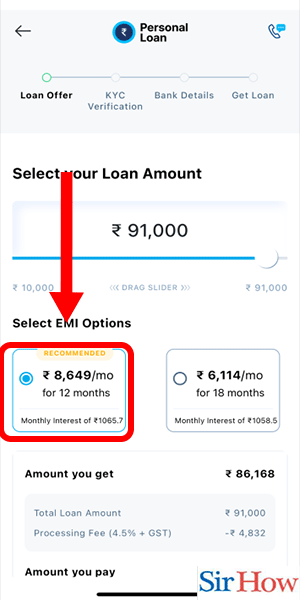

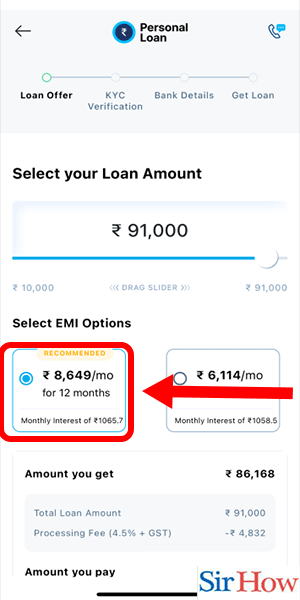

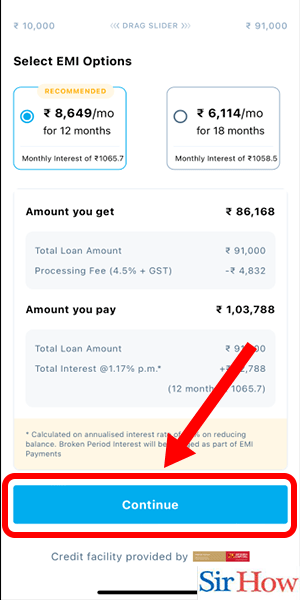

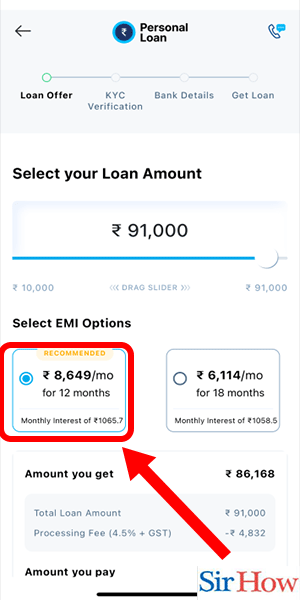

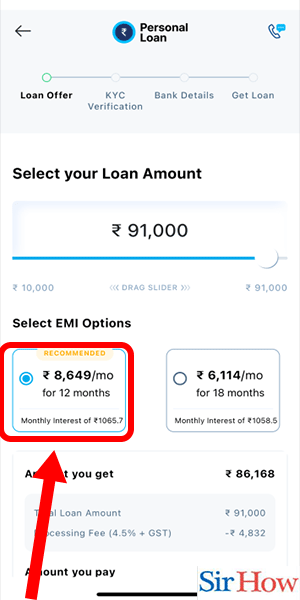

Step 6: Select loan offer - Once you have confirmed your occupational details, you will be presented with several loan offers from Paytm's lending partners.

- Select the loan offer that best suits your needs and preferences.

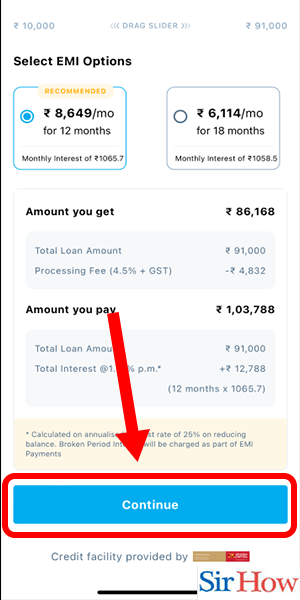

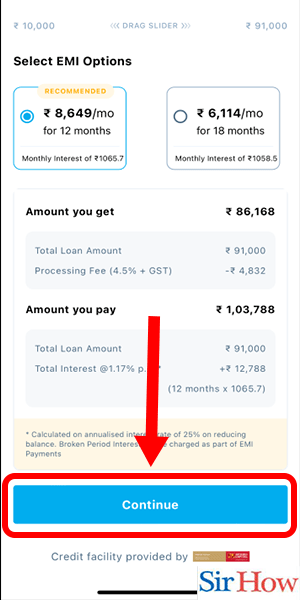

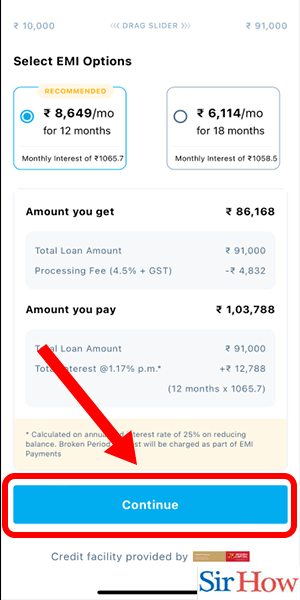

Step 7: Tap on continue - Finally, tap on the "Continue" button to proceed with your loan application.

- Your application will be reviewed by Paytm's lending partners, and you will be notified of the status of your loan application via SMS or email.

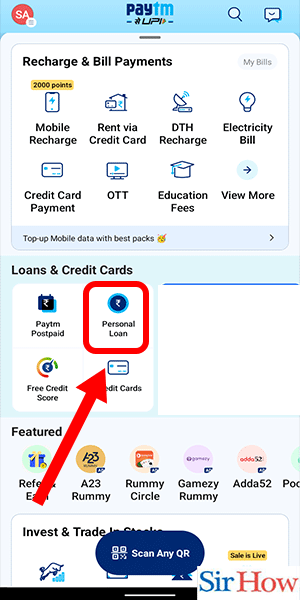

Get loan option on home page: 6 Steps

Step 1: Open paytm app - Open the Paytm app on your mobile device.

- Make sure you have the latest version of the Paytm app installed.

- Check your internet connection to avoid interruptions during the process.

Step 2: Tap on 'personal loan' - On the app homepage, you will see the ‘Personal Loan’ option, click on it.

- Read and understand the terms and conditions of the loan carefully.

- Check your eligibility criteria before applying to avoid rejections.

Step 3: Enter personal details & tap on proceed - Enter your personal details such as name, age, gender, contact details, etc. and click on ‘Proceed’.

- Ensure that the information you enter is accurate and matches your official documents.

- Keep your PAN card and Aadhaar card details handy for a smooth process.

Step 4: Enter occupational details & click proceed - Enter your occupation details, such as your job type, salary, work experience, etc. and click on ‘Proceed’.

- Make sure that your occupation details match with your bank statement.

- Be honest while entering your occupation details to avoid loan rejection.

Step 5: Select loan offer - Select the loan offer that best suits your financial needs and repayment capacity.

- Understand the interest rate, processing fees, and other charges before selecting the loan offer.

- Choose a loan amount that you can easily repay in the given tenure.

Step 6: Click continue - Once you have selected the loan offer, click on ‘Continue’ to proceed with the loan application process.

- Keep all the necessary documents ready, such as bank statements, salary slips, etc.

- Keep an eye on your email and phone for further communication from Paytm regarding your loan application.

Search for personal loan under search tab: 7 Steps

Step 1: Open paytm app - The first step is to open the Paytm app on your smartphone. If you don't have the app installed, then download it from the App Store or Google Play Store.

- Make sure you have a stable internet connection to avoid any interruption during the loan application process.

- Keep your ID proofs handy for verification purposes.

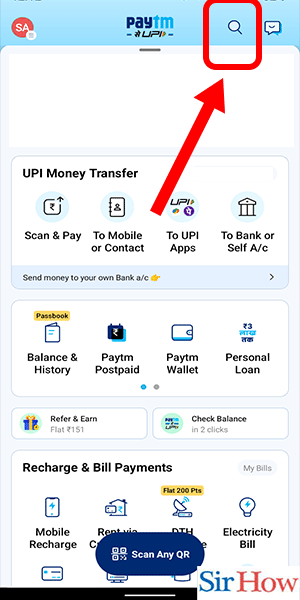

Step 2: Search for 'personal loan' - On the Paytm home page, you will find a search bar on the top. Type ‘Personal Loan’ in the search bar, and you will see a list of options.

- Go through the terms and conditions of the loan before applying.

- Understand the eligibility criteria and ensure that you meet them before applying.

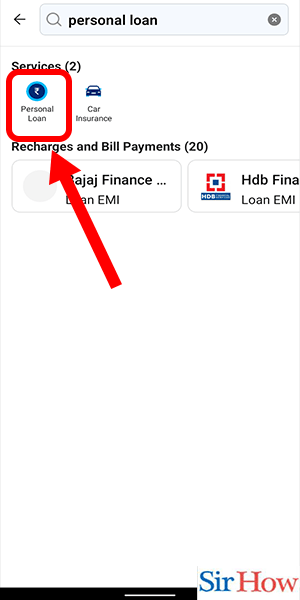

Step 3: Select personal loan - From the list of options, select the ‘Personal Loan’ option.

- Check the interest rates and processing fees of the loan before selecting.

- Compare the loan offers with other financial service providers to make an informed decision.

Step 4: Enter details & tap on proceed - Now, you will be asked to enter your personal and financial details, such as name, age, income, PAN number, etc. Fill in the details carefully and tap on the ‘Proceed’ button.

- Make sure to enter accurate information to avoid any discrepancy during the verification process.

- Keep your income proof and bank statement handy to fill in the required details.

Step 5: Enter details & click on confirm - After filling in your details, you will be asked to confirm them. Verify all the details entered by you and click on the ‘Confirm’ button.

- Double-check the details to avoid any mistake.

- Make sure that the mobile number and email ID entered by you are correct and functional.

Step 6: Select loan offer - Once your details are verified, you will receive a list of loan offers. Select the one that suits you the best.

- Check the loan amount, repayment tenure, and EMI before selecting the offer.

- Read the terms and conditions of the loan offer thoroughly before accepting it.

Step 7: Click on continue - After selecting the loan offer, click on the ‘Continue’ button, and your loan application will be submitted.

- Keep checking your email and SMS for loan application status updates.

- Contact Paytm customer support if you face any issue during the loan application process.

Get loan option under balance & history: 7 Steps

Step 1: Open paytm app - To get started, open the Paytm app on your mobile device. Make sure that you have the latest version of the app installed.

- Check your eligibility for a personal loan in advance by using Paytm's loan eligibility calculator.

- Make sure that you have a good credit score and a stable source of income to increase your chances of getting approved for a loan.

- If you have any existing loans or credit card debts, try to clear them before applying for a personal loan.

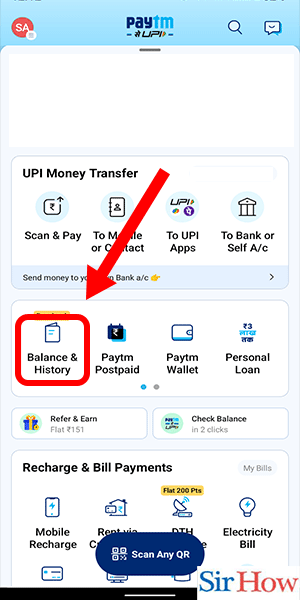

Step 2: Tap on balance & history tab - Once you are logged in to the app, tap on the "Balance & History" tab located at the bottom of the screen.

- Make sure that your Paytm account is fully verified with your KYC documents before applying for a loan.

- If you are a new user, you may need to complete some additional steps to verify your account before applying for a loan.

- If you have any pending payments or dues on your Paytm account, clear them first to avoid any issues with loan approval.

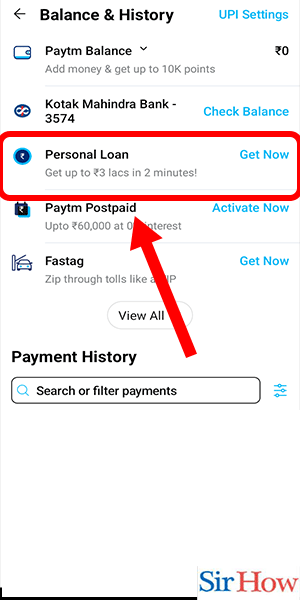

Step 3: Tap on personal loan - Under the "Balance & History" tab, you will see an option for "Personal Loan." Tap on it to proceed with your loan application.

- Read the terms and conditions carefully before applying for a loan to understand the interest rates, repayment tenure, and other details.

- Check if you are eligible for any pre-approved loan offers on your account before applying for a loan.

- Make sure that you have all the required documents handy before applying for a loan, including your ID proof, address proof, income proof, and bank statements.

Step 4: Enter details & tap on proceed - On the loan application page, enter your personal details, including your name, date of birth, mobile number, and email address. Once you have filled in the required fields, tap on "Proceed."

- Double-check the information you have entered before submitting the loan application to avoid any errors or discrepancies.

- Make sure that the mobile number and email address you have provided are correct and active, as these will be used for communication during the loan approval process.

- If you have any co-applicants for the loan, make sure to enter their details accurately as well.

Step 5: Enter occupational details - Next, you will need to enter your occupational details, including your employment type, company name, monthly income, and work experience. Fill in the required fields and tap on "Proceed" to move to the next step.

- Make sure that the employment and income details you provide are accurate and up-to-date, as these will be used to determine your loan eligibility and repayment capacity.

- If you are self-employed, make sure that you have all the necessary documents to prove your income, such as income tax returns, bank statements, and business proof.

- If you are a salaried employee, make sure that you provide details of a stable job and a consistent income source.

Step 6: Select loan offer - On the loan offer page, you will see various loan options based on your eligibility and credit score. Select the loan offer that suits your requirements and repayment capacity.

Step 7: Click continue - The final step is to review the loan offer details and click on "Continue" to submit your loan application.

- Review all the terms and conditions, interest rates, processing fees, and other charges associated with the loan offer before accepting it.

- Make sure that you have read and understood the loan agreement before accepting the loan offer.

- After submitting your loan application, keep track of the status of your loan application through the Paytm app or website.

Getting a personal loan from Paytm is a simple and hassle-free process that can be completed within minutes using their mobile app. By following the steps outlined in this blog post and keeping in mind the tips provided, you can increase your chances of getting approved for a loan and make the most of this convenient financial service.

Tips

- Check your eligibility for a personal loan in advance using Paytm's loan eligibility calculator.

- Make sure that your Paytm account is fully verified with your KYC documents before applying for a loan.

- Read the terms and conditions carefully before applying for a loan to understand the interest rates, repayment tenure, and other details.

- Double-check the information you have entered before submitting the loan application to avoid any errors or discrepancies.

- Make sure that the employment and income details you provide are accurate and up-to-date, as these will be used to determine your loan eligibility and repayment capacity.

- Compare the interest rates and processing fees of different loan offers before selecting the one that suits your requirements.

- Keep track of the status of your loan application through the Paytm app or website.

FAQ

What is the minimum and maximum amount of personal loan I can get from Paytm?

Ans: The minimum and maximum amount of personal loan that you can get from Paytm depends on your credit score and repayment capacity.

How long does it take to get a personal loan from Paytm?

Ans: The loan approval process usually takes 2-3 working days, and the loan amount is disbursed within 24 hours after approval.

Can I prepay my Paytm personal loan?

Ans: Yes, you can prepay your Paytm personal loan without any additional charges.

What are the documents required to apply for a personal loan from Paytm?

Ans: The documents required to apply for a personal loan from Paytm include ID proof, address proof, income proof, and bank statements.

Is there any processing fee for a personal loan from Paytm?

Ans: Yes, there is a processing fee of up to 2% of the loan amount for a personal loan from Paytm.

Can I apply for a personal loan from Paytm if I don't have a credit score?

Ans: Paytm considers various factors, including your income and repayment capacity, while evaluating your loan application. However, having a good credit score increases your chances of getting approved for a loan.

Can I apply for a personal loan from Paytm if I am self-employed?

Ans: Yes, self-employed individuals can also apply for a personal loan from Paytm by providing the necessary documents to prove their income and repayment capacity.

Related Article

- How to Invite on Paytm App

- How to Choose Language on Paytm App

- How to Book Movie Tickets using Paytm App

- How to Recharge Mobile Phone through Paytm

- How to Pay Credit Card Bill through Paytm App

- How to Pay Electricity Bill through Paytm App

- How to Recharge Paytm

- How to use Paytm for Shopping and Pay Bills

- More Articles...