- Paytm

- delete bank account

- find qr code

- earn cashback paytm

- login paytm forgot

- pay bwssb paytm

- pay bsnl landline

- pay upi payment

- recharge axis paytm

- recharge jiofi with paytm

- recharge tv paytm

- pay water bill

- refer friend paytm

- pay lic premium

- pay money paytm

- refund money google play

- refund money paytm

- book tatkal train

- buy fastag paytm

- buy paytm gold

- make paytm account

- pay using upi

- pay through credit

- recharge airtel fastag

- recharge fastag paytm

- check paytm coupons

- create paytm business

- call paytm mall

- buy truecaller premium

- pay act fibernet

- pay cesc bill

- pay lic paytm

- pay property tax

- buy google play gift card

- buy amazon voucher

- download paytm qr code

- download paytm invoice

- enable fingerprint paytm

- find movie ticket

- online payment through

- download paytm statement

- generate merchant paytm

- find scratch paytm

- increase paytm merchant

- know paytm balance

- logout paytm devices

- make credit card

- pay icici card

- recharge d2h through

- recharge hdfc fastag

- recharge data pack

- book ipl tickets

- book mumbai metro

- apply paytm swipe

- avail paytm postpaid

- activate paytm first

- see received money

- register paytm mall

- pay uppcl electricity

- pay kesco bill

- pay electricity bill

- pay igl bill

- pay manappuram gold

- pay bharat gas

- know paytm bank

- change merchant name

- check paytm number

- talk with customer

- chat in paytm

- redeem paytm first

- remove payment history

- see payment history

- send qr code

- update paytm app

- add money metrocard

- apply coupon paytm

- buy gift cards

- change paytm phone

- change paytm language

- create merchant id

- use paytm cashback

- pay paytm wallet

- send money paytm

- delete paytm

- install paytm

- money paytm wallet

- delete paytm account

- paytm wallet account

- fastag balance paytm

- upi pin ipaytm

- use paytm wallet money

- get paytm speaker

- find paytm upi id

- add bank account paytm

- bank account paytm

- change paytm upi id

- block someone paytm

- check paytm bank account number

- get loan paytm

- remove saved cards paytm

- activate offer in paytm

- flipkart using paytm

- how to check paytm offers

- received money paytm

- reactivate paytm account

- complain to paytm

- activate paytm postpaid

- play games paytm

- track paytm order

- paytm through email

- recharge paytm fastag

- use paytm postpaid

- deactivate paytm postpaid

- cibil score paytm

- deactivate fastag paytm

- credit card paytm

- paytm merchant account

- automatic payment paytm

- find vpa paytm

- paytm order id

- paytm notifications

- change passcode paytm

- credit money paytm

- delink aadhar paytm

- airtel dth paytm

- food from paytm

- book gas paytm

- how to create fd in paytm

- default paytm money

- paytm scan pay

- paytm shopping voucher

- internet recharge paytm

- paytm scratch card

- bike insurance paytm

- paytm debit card

- card bill paytm

- bhim upi paytm

- paytm first membership

- recharge hotstar paytm

- tdr on paytm

- pnr status paytm

- wishlist in paytm

- bank paytm wallet

- check passbook in paytm

- become paytm merchant

- create paytm link

- claim paytm insurance

- earn money paytm

- paytm bank account

- paytm qr code

- qr code whatsapp

- setup paytm lite

- request paytm bank statement

- complete kyc in paytm

- remove kyc from paytm

- check paytm kyc

- paytm wallet money to paytm bank

- get paytm refund

- paytm qr code shopkeepers

- cancel bus ticket in paytm

- transfer money paytm to phonepe

- paytm for business

- transfer money phonepe to paytm

- pay through qr scan paytm

- check paytm gold balance

- check paytm wallet number

- add credit card in paytm

- add money paytm wallet debit

- landline bill through paytm

- remove paytm contacts

- cancel an order on paytm

- verify email address paytm

- cancel train tickets paytm

- cancel flight ticket paytm

- add debit card in paytm

- check transaction id in paytm

- free recharge in paytm

- cancel movie tickets paytm

- open paytm bank account

- check paytm balance

- verify paytm account for kyc

- book train tickets paytm

- change email paytm

- apply paytm card

- get paytm statement

- remove bank acc. from paytm

- electricity bill receipt paytm

- pay traffic challan paytm

- transfer money bank to paytm

- paytm recharge history

- check bank balance in paytm

- add promo code paytm

- add money paytm wallet

- recharge jio with paytm

- check paytm transaction history

- change password paytm

- create paytm account

- check paytm limit

- create upi pin paytm

- check cashback paytm

- book bus tickets paytm

- transfer money paytm to bank account

- reset paytm password

- transfer money paytm to paytm

- add beneficiary paytm

- share personal qr paytm

- pay institution fees paytm

- verify mobile number paytm

- recharge metro card paytm

- check inbox on paytm

- enable/disable notifications paytm

- pay dth bill paytm app

- log out paytm app

- contact paytm for help

- change profile picture paytm

- change username on paytm app

- security setting paytm app

- book hotel room paytm

- book flight tickets paytm

- helpline number on paytm app

- pay datacard bill paytm app

- pay water bills paytm app

- recharge google play paytm

- update mobile number paytm

- invite on paytm app

- choose language paytm

- book movie tickets paytm

- recharge mobile paytm

- pay credit card bill paytm

- pay electricity bill paytm

- how to recharge paytm

How To Check Cibil Score In Paytm

Are you looking to check your Cibil score but find the process tedious and time-consuming? Well, here's some good news for you. Paytm, one of India's leading digital payment platforms, now offers the convenience of checking your Cibil score in just a few clicks. With this new feature, you can keep track of your creditworthiness and take steps to improve your credit score effortlessly. In this blog post, we'll guide you through the process of checking your Cibil score on Paytm and give you some insights on how to maintain a healthy credit score. So, let's get started and explore the benefits of checking your Cibil score on Paytm.

Check cibil score under home page: 4 Steps

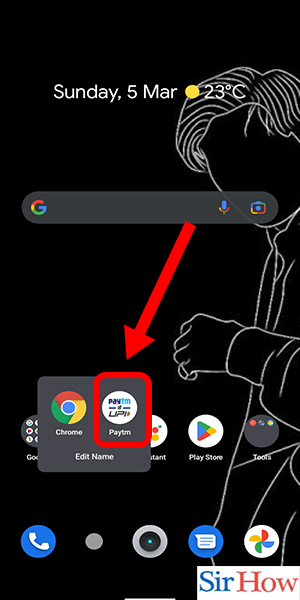

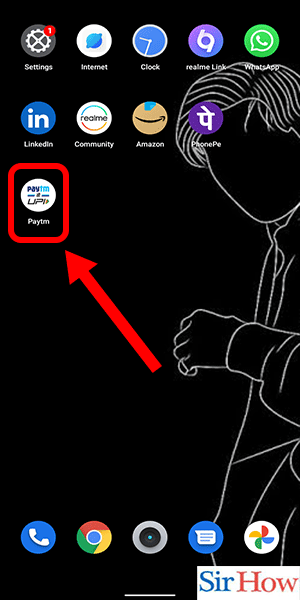

Step 1: Open paytm app - Open the Paytm app on your smartphone.

- Ensure that you have the latest version of the app installed.

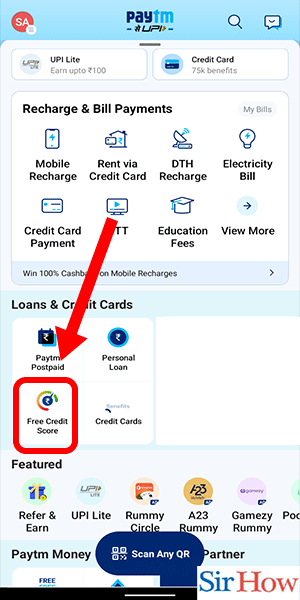

Step 2: Tap on 'check credit score' - On the Paytm homepage, look for the ‘My Money’ section at the bottom of the screen.

- Tap on ‘Check Credit Score’ to proceed.

- Ensure that you have a stable internet connection to avoid any delays or interruptions while checking your credit score.

- Make sure that you have your personal details such as your name, date of birth, PAN card number, and address details readily available before starting the process.

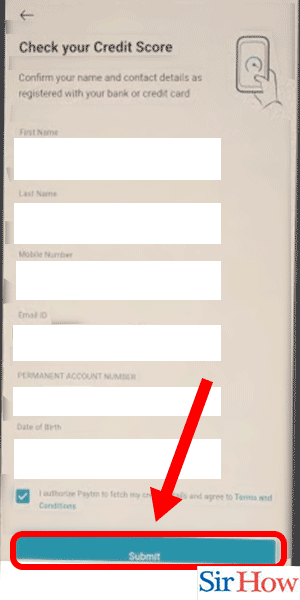

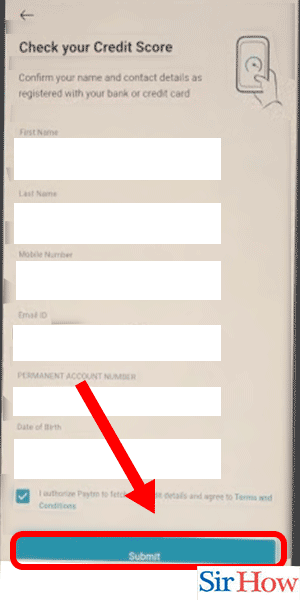

Step 3: Enter your details & tap on submit - Enter your personal details such as your name, date of birth, PAN card number, and address details as requested on the form.

- Verify that the details you have entered are correct and tap on ‘Submit’.

- Ensure that you have entered accurate details to get an accurate credit score.

- Double-check your details before submitting to avoid any errors.

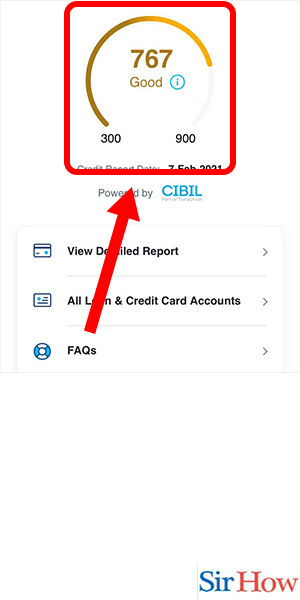

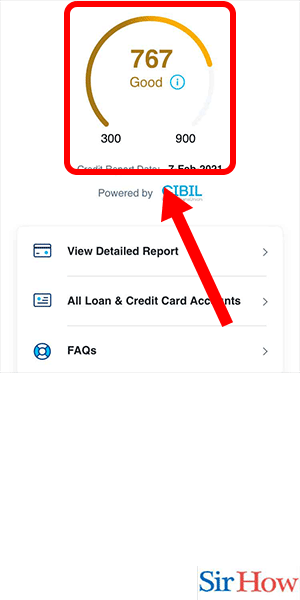

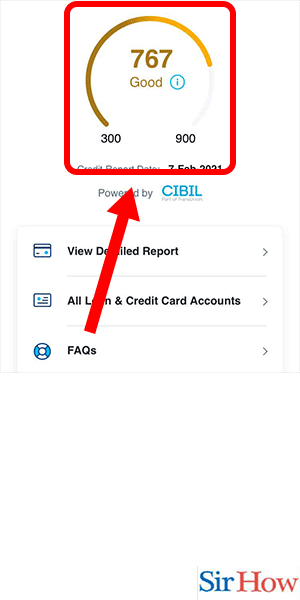

Step 4: Credit score is visible - Once you have submitted your details, your credit score will be displayed on the screen.

- If you have a low credit score, Paytm provides tips and advice on how to improve it.

- If you have a high credit score, you can use this to your advantage when applying for loans and other financial products.

Check credit score under loan & credit card tab: 5 Steps

Step 1: Open paytm app - To begin the process, open the Paytm app on your mobile phone.

- Make sure you have the latest version of the Paytm app installed on your phone.

- If you don't have a Paytm account, create one by providing your details and verifying your phone number.

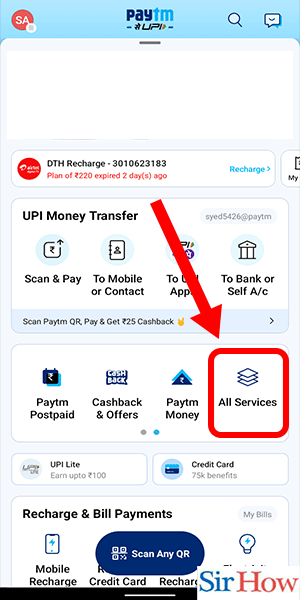

Step 2: Tap on all services - Once you open the app, you will see various options on the home screen. Tap on the "All Services" tab to proceed.

- If you are unable to find the "All Services" tab, use the search bar to look for it.

- You can also access the "All Services" tab by swiping right from the home screen.

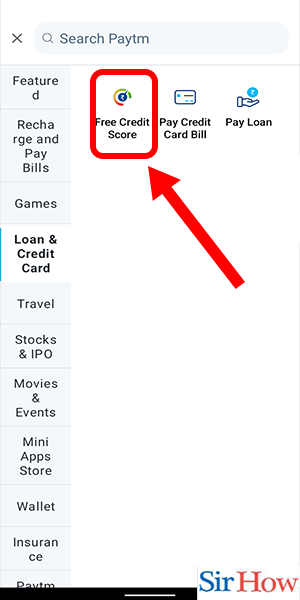

Step 3:Tap on check credit score - In the "All Services" section, scroll down until you find the "Check Credit Score" option. Tap on it to continue.

- Make sure you have a stable internet connection to avoid any errors during the process.

- Keep your personal details, such as your name, address, and PAN card number, handy.

Step 4: Enter your details - To check your Cibil score, you need to provide some personal information, such as your name, address, PAN card number, and date of birth. Fill in the details correctly and tap on "Proceed."

- Double-check the information you provide to avoid any errors.

- If you are not comfortable sharing your PAN card number, you can use other forms of identification, such as your passport or driving license.

Step 5: Cibil score is visible - Once you have provided your details, your Cibil score will be displayed on the screen. You can also see your Cibil report by tapping on the "View Report" button.

- Check your Cibil score regularly to monitor your creditworthiness.

- If your Cibil score is low, take steps to improve it, such as paying your bills on time, reducing your credit utilization, and maintaining a healthy credit history.

Check cibil score by searching: 4 Steps

Step 1: Open paytm app - Launch the Paytm app on your mobile device.

- Make sure you are logged in to your Paytm account.

- Ensure that your Paytm app is updated to the latest version to get the best experience and accurate results.

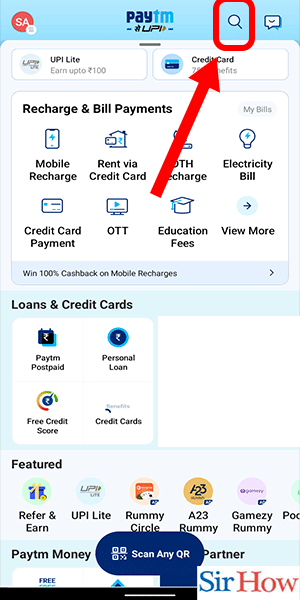

Step 2: Search for 'credit score' - On the homepage, look for the search bar located at the top of the screen.

- Type 'credit score' and click on the magnifying glass icon.

- Use specific keywords in the search bar to get relevant results quickly.

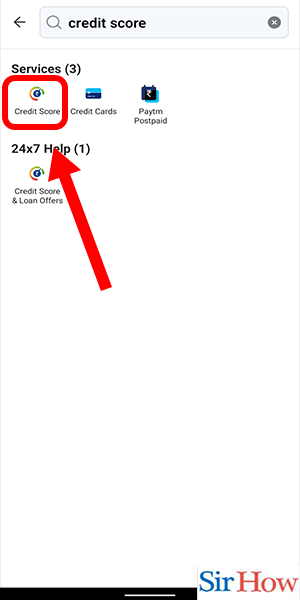

Step 3: Tap on 'check credit score' - Once the search results appear, look for the 'Credit Score' option.

- Tap on it to proceed to the credit score check page.

- Make sure you have a stable internet connection to avoid any interruptions during the process.

Step 4: Enter your details & credit score is visible - Enter your personal details, such as your name, date of birth, and PAN card number.

- Verify your details and click on 'Submit.'

- Your CIBIL score will appear on the screen.

- Double-check the details you entered before submitting to avoid any errors.

Check your cibil score on paytm website: 4 Steps

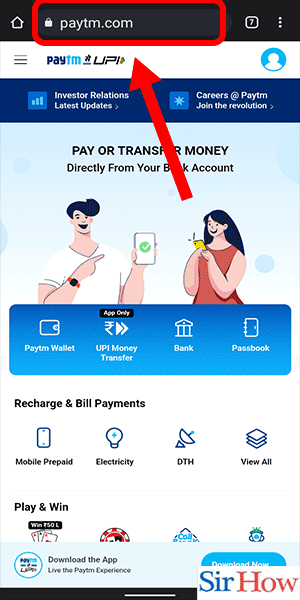

Step 1: Visit 'paytm.com' - Open a web browser and go to paytm.com

- Make sure you are logged in to your Paytm account

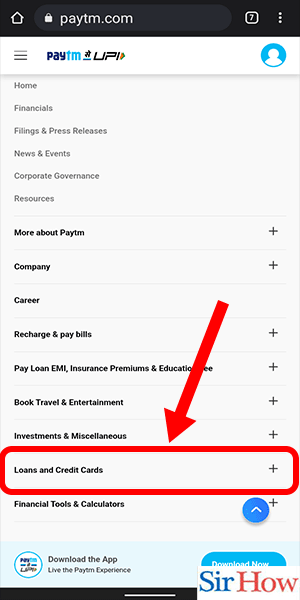

Step 2: Scroll down & select 'loans & credit cards' - Once you are on the Paytm homepage, scroll down to the bottom of the page

- Under the ‘Financial Services’ section, click on ‘Loans & Credit Cards’

- Make sure you are on the official Paytm website to avoid fraudulent websites that may ask for your personal information.

- If you don't have a Paytm account, create one to access the credit report section.

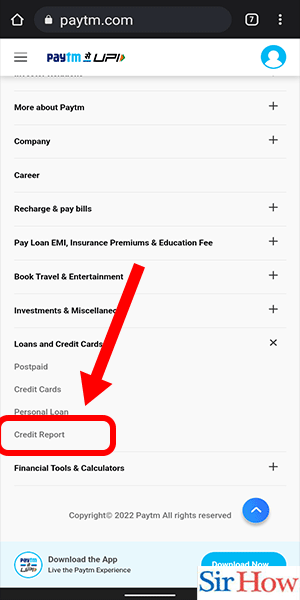

Step 3: Select 'credit report' - After clicking on ‘Loans & Credit Cards,’ you will be redirected to the Credit Cards and Loans page

- Click on the ‘Credit Report’ tab

- Ensure that your Paytm account has been active for at least six months before accessing your credit report.

- Keep your PAN card number and other personal details handy before you begin checking your credit report.

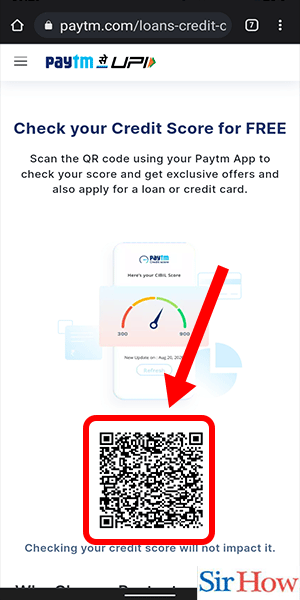

Step 4: Scan the QR to check credit score - Once you click on the ‘Credit Report’ tab, you will be asked to verify your personal details

- Scan the QR code with your phone's camera to check your CIBIL score

- Double-check your personal details such as name, address, and date of birth before scanning the QR code.

- Ensure that your phone's camera is working correctly to avoid errors while scanning the QR code.

Checking your CIBIL score is essential to understand your creditworthiness and financial health. By following the above steps, you can quickly check your CIBIL score in Paytm. Always ensure that you are using the official Paytm website to avoid fraudulent activities.

Tips

- Check your CIBIL score regularly to keep track of your creditworthiness.

- Pay your bills and debts on time to maintain a good credit score.

- Avoid applying for multiple loans or credit cards simultaneously, as it can lower your credit score.

FAQ

Q1. Is it safe to check my CIBIL score online through Paytm?

A1. Yes, it is safe to check your CIBIL score online through Paytm, as it is a legitimate website that follows all the necessary security protocols.

Q2. Can I check my CIBIL score for free on Paytm?

A2. No, Paytm charges a nominal fee for checking your credit report, which includes your CIBIL score.

Q3. How often should I check my CIBIL score?

A3. It is advisable to check your CIBIL score at least once every six months to monitor any changes and rectify any discrepancies.

Q4. What is a good CIBIL score?

A4. A CIBIL score of 750 or above is considered good and increases your chances of getting approved for loans or credit cards.

Q5. What are the factors that affect my CIBIL score?

A5. Your CIBIL score is affected by factors such as your credit history, payment history, credit utilization, and credit inquiries.

Q6. Can I improve my CIBIL score if it is low?

A6. Yes, you can improve your CIBIL score by paying your bills and debts on time, reducing your credit utilization, and maintaining a healthy credit history.

Related Article

- How to Apply Coupon in Paytm

- How Buy Gift Cards on Paytm

- How to Change Paytm Phone Number Without Old Number

- How to Change Paytm Language

- How to cancel autopay in Phonepe

- How to Create Merchant ID in Paytm

- How To Use Paytm Cashback Points

- How To Scan And Pay From Paytm Wallet

- How To Send Money From Paytm

- How To Delete Paytm

- More Articles...