- Bangalore

- order food

- admission in iisc

- ration card

- marriage certificate

- pay road tax

- property tax

- birth certificate

- electricity bill (bescom)

- traffic fines

- driving licence

- aadhar card

- learn swimming

- schengen visa bangalore

How to Pay Property Tax in Bangalore (BBMP)

Paying property tax is an essential obligation for all property owners in Bangalore (BBMP). The property tax is calculated based on the value of the property and is collected annually by the BBMP (Bruhat Bengaluru Mahanagara Palike) to provide necessary infrastructure facilities and services to the residents of Bangalore. In this article, we will guide you on how to pay property tax in Bangalore (BBMP) online, which is the most convenient and hassle-free way to pay your property tax.

Pay Property Tax in Bangalore (BBMP) 5 steps

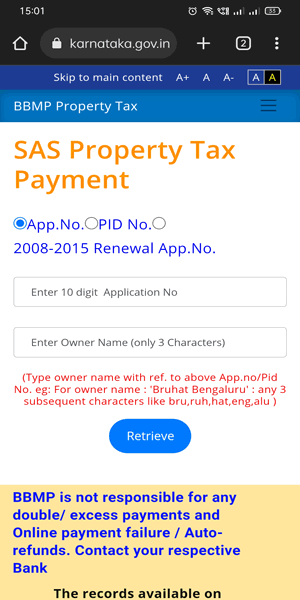

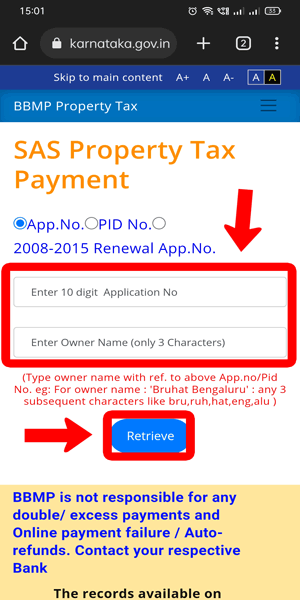

Step 1: Go to BBMP property tax - The first step to pay your property tax in Bangalore is to visit the official BBMP property tax portal at https://bbmptax.karnataka.gov.in.

Step 2: Enter your details and continue - Enter your property identification number (PID) or the old SAS property identification number, which is mandatory to pay property tax. You can find your PID or SAS number on your previous tax receipt.

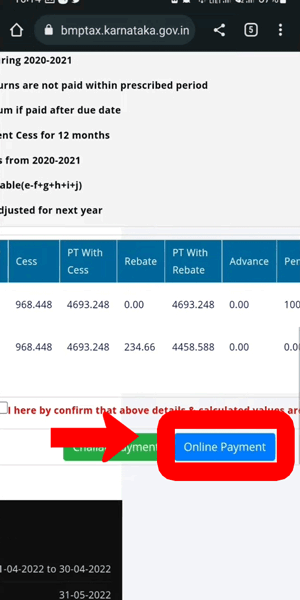

Step 3: Click on Online Payment - After entering the required details, click on the 'Online Payment' option.

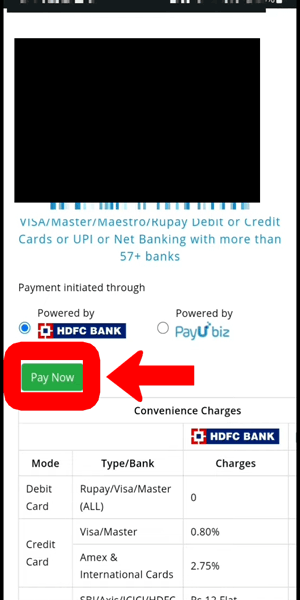

Step 4: Click on pay now - The next step is to click on the 'Pay Now' option to proceed with the payment.

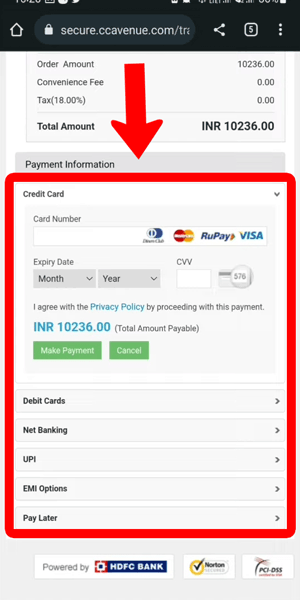

Step 5: Select your payment method and proceed to pay - Finally, select your preferred payment method, such as credit/debit card, internet banking, or e-wallets, and proceed with the payment. Once the payment is completed, you will receive a receipt of the transaction, which can be saved or printed for future reference.

Paying property tax in Bangalore (BBMP) is a crucial responsibility for all property owners, and the online payment system has made it easier and more convenient than ever before. By following the above-mentioned steps, you can pay your property tax online from the comfort of your home or office. It is important to note that timely payment of property tax not only helps you avoid penalties but also contributes to the development of your city's infrastructure.

FAQ

Q1) What is the deadline for paying property tax in Bangalore (BBMP)?

Ans: The deadline for paying property tax in Bangalore (BBMP) is generally April 30th of each year.

Q2) What are the consequences of not paying property tax on time in Bangalore (BBMP)?

Ans: Failure to pay property tax on time may result in penalties and fines, and the BBMP may initiate legal proceedings against the defaulter.

Q3) Can I pay property tax in Bangalore (BBMP) offline?

Ans: Yes, you can pay property tax in Bangalore (BBMP) offline by visiting any BBMP office and making the payment through cash or cheque.

Q4) How is the property tax calculated in Bangalore (BBMP)?

Ans: The property tax is calculated based on the property's location, size, usage, and age, and is subject to revision every five years.

Q5) Is it necessary to pay property tax if I have already paid stamp duty and registration fees?

Ans: Yes, paying stamp duty and registration fees is a one-time payment during property purchase, whereas property tax is an annual tax that must be paid by all property owners to the BBMP.

Related Article

- How to Order Food Online in Bangalore

- How to Get Admission in IISC Bangalore

- How to Apply Ration Card Online in Bangalore

- How to Get a Marriage Certificate in Bangalore

- How to Pay Road Tax in Bangalore

- How to Apply for a Birth Certificate Online in Bangalore

- How to Pay Bangalore electricity bill (BESCOM) Online

- How to Check and Pay Traffic Fines in Bangalore

- How to apply Driving Licence online in Bangalore

- How to apply for aadhar card online in Bangalore

- More Articles...